Navigating the world of crypto is an exciting journey, and finding the right exchange is key, especially in Australia, where the crypto exchange scene is flourishing. With so many options out there, each with its own set of features, fees, and experiences, making the right choice can seem a bit daunting.

That’s where we come in. We’ve carefully reviewed the top 10 cryptocurrency exchanges in Australia, taking into account important factors like ease of use, security, the variety of cryptocurrencies available, adherence to local regulations, fee structures, and customer support among other things.

Whether you’re an experienced trader or just starting, our comparison guide is designed to offer you thorough insights and unbiased reviews. Our goal is to help you find an exchange that not only meets your trading needs but also matches your personal preferences!

Best Crypto Exchanges in Australia for 2024

- Best Australian Crypto Exchange Overall: Swyftx

- Best Exchange for Beginners: CoinSpot

- Best Crypto Exchange for Day Traders: Binance

- Great UI Design: Bybit

- Longest-standing Australian Cryptocurrency Exchange: CoinJar

- Best Exchange for NZ: Independent Reserve

- Best for Mobile App Trading: Crypto.com

Why Trust Crypto Head

We have been committed to providing our readers with well-researched, unbiased, and reliable information since 2017. Our team consists of crypto experts who understand the importance of choosing the right exchange.

We have spent a huge amount of time over the years evaluating and comparing a range of crypto platforms. We use a rigorous methodology to evaluate each platform, considering factors like security, user experience, and fees.

226

Exchanges considered

141

Exchanges analysed

9,165

Data points collected

1. Swyftx - Best Australian Crypto Exchange Overall

Trading Fees

0.1% - 0.60%

Supported Crypto

350+

Supported Fiat Currencies

USD, AUD, NZD

AUSTRAC Registered This exchange is registered with AUSTRAC. Digital currency exchange providers in Australia are required to be registered with AUSTRAC. This ensures they must comply with relevant AML and CTF laws or risk facing heavy penalties. You can read more about this on AUSTRAC's website. This registration should not be viewed as an official endorsement or guarantee of services.

Get $20 BTC credit when you sign up through our link.

Looking at all the exchanges we’ve reviewed, Swyftx – an AUSTRAC-registered cryptocurrency exchange based in Milton, QLD – is by far the best crypto trading platform for local traders.

Swyftx is renowned for its user-friendly interface, which facilitates trading in an extensive range of cryptocurrencies with low fees. Its rapid, two-minute KYC process, in compliance with AML policies, ensures a secure and lawful trading environment.

Swyftx distinguishes itself with its transparent pricing and robust security measures, positioning it as the ideal platform for novice and experienced traders in Australia.

It is really comforting to learn that there is a locally based exchange offering 350+ cryptocurrencies that can be traded against USD, AUD, NZD, and BTC. This means that beginners no longer have to worry about exchanging fiat into crypto on other platforms.

Another notable aspect of Swyftx is its transparent pricing system – the exchange boasts some of the most competitive fees in the industry. The trading fee is a nominal 0.1% - 0.60%, and there are no fees on deposits and withdrawals. Compared to the industry average spread of 5.2%, Swyftx charges between 0.2% and 0.8%.

Being a fully licensed exchange, Swyftx adheres to AML and KYC policies. To streamline the upfront KYC process, the platform implements transaction monitoring programs, enabling users to complete the registration and verification process in just two minutes. By completing the KYC check, users are granted a daily deposit limit of 20,000 AUD.

In terms of security, it is important to know that the platform diligently secures user accounts using 2FA and breached password detection, alongside frequent penetration testing conducted by experts.

At this point, it can be confidently stated that no other cryptocurrency exchange in Australia matches the overall user experience quality offered by Swyftx. This is why our team wholeheartedly recommends Swyftx as the best place to buy crypto.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer - Osko, PayID) | 0% |

| Deposit Fee (Credit/Debit Card) | 1.99% |

| Trading Fee | 0.1% - 0.60% |

| Withdrawal Fee (Bank Transfer) | 0% |

2. CoinSpot - Best Exchange for Beginners

Trading Fees

0.10% - 1%

Supported Crypto

441+

Supported Fiat Currencies

AUD

AUSTRAC Registered This exchange is registered with AUSTRAC. Digital currency exchange providers in Australia are required to be registered with AUSTRAC. This ensures they must comply with relevant AML and CTF laws or risk facing heavy penalties. You can read more about this on AUSTRAC's website. This registration should not be viewed as an official endorsement or guarantee of services.

CoinSpot is a great Australian crypto exchange with its user-friendly interface and broad appeal, making it a go-to choice for both beginners and seasoned traders in Australia.

The platform’s support for a vast array of cryptocurrencies, coupled with multiple deposit options, offers great flexibility. Despite a fee structure that is slightly above the industry average, CoinSpot’s commitment to customer service excellence and its OTC desk for institutional traders solidify its position as one of the most accessible and reliable cryptocurrency exchanges in the country.

CoinSpot is a well-established Australian cryptocurrency exchange that launched in 2013. Known for its easy-to-use interface, CoinSpot is a popular entry point for novice and experienced traders. The platform stands out for supporting a diverse range of cryptocurrencies, including major ones like Bitcoin and Ethereum, as well as some lesser-known altcoins.

Upon exploring the platform, users will find various deposit methods at their disposal, including Bank Transfer, Debit Card, Credit Card, Cryptocurrency, PayID, BPAY. CoinSpot also caters to institutional traders, offering an Over-The-Counter (OTC) desk for large-volume orders.

One aspect to consider is CoinSpot’s fee structure, which charges slightly higher commissions than the industry average. Transaction fees for buying, selling, and trading cryptocurrencies are set at 0.10% - 1%, a rate that also applies to stop-loss, buy-stop, and buy-limit orders.

Registration on CoinSpot requires users to submit a government-issued ID photo and a scanned copy of a utility bill for address verification. A standout feature of CoinSpot is its exceptional customer service, characterized by a highly responsive team, making it arguably the easiest crypto exchange in Australia.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer - PayID) | 0% |

| Deposit Fee (Credit/Debit Card) | 2.58% |

| Trading Fee | 0.10% - 1% |

| Withdrawal Fee (Bank Transfer) | 0% |

3. Binance - Best Crypto Exchange for Day Traders

Trading Fees

0.10%

Supported Crypto

386+

Supported Fiat Currencies

USD, GBP, CAD, EUR, NZD + 75 others Some through third party apps.

AUSTRAC Registered This exchange is registered with AUSTRAC. Digital currency exchange providers in Australia are required to be registered with AUSTRAC. This ensures they must comply with relevant AML and CTF laws or risk facing heavy penalties. You can read more about this on AUSTRAC's website. This registration should not be viewed as an official endorsement or guarantee of services.

Please note: Binance has had regulatory challenges in the U.S. and EU. Binance was fined $4b on 21st Nov 2023 by a coordinated effort between the Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) and Office of Foreign Assets Control (OFAC) and the U.S. Commodity Futures Trading Commission (CFTC). Binance still remains the most used exchange in the world, but we would proceed with caution.

Binance has been chosen as a premier global cryptocurrency service for its vast array of trading opportunities and rapid growth since its inception in 2017.

The platform’s extensive range of cryptocurrencies and advanced trading features, including the unique BNB token for fee discounts, make it ideal for advanced traders.

Its commitment to security, demonstrated by the innovative Secure Asset Fund for Users (SAFU), reassures users of their funds’ safety. Coupled with some of the lowest fees in the industry, Binance sets itself apart as a trustworthy and feature-rich cryptocurrency exchange.

Binance is always the first choice for international crypto services. The platform was launched in 2017, it has very quickly grown to the largest exchange in the world due to the rich diversity of trading opportunities under one roof.

Binance was originally headquartered in China, but due to regulatory problems, the company was relocated to Malta, an island known for being crypto-friendly.

First and foremost, traders worldwide praise Binance for the variety of cryptocurrencies it has on offer.

Binance is one of the best crypto exchanges for advanced traders. It’s one of the best crypto platforms for advanced features – they even have a native token called BNB that traders can use to get a discount on the trading fees, i.e., cut them in half.

In terms of user and account protection, you get the impression of dealing with a trustworthy platform that goes the extra mile to introduce top-notch security methods for its customers’ funds.

The best feature that sets this platform apart is the Secure Asset Fund for Users (SAFU) which functions as this pooling vault to which Binance distributes 10% of all collected fees.

In May 2019, when the platform was hacked successfully, Binance was able to reimburse the lost funds to its users by drawing out funds from SAFU.

On top of this, Binance also has some of the lowest fees you can find.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | 0% - 2% |

| Deposit Fee (Credit/Debit Card) | 0% - 2% |

| Trading Fee | 0.10% |

| Withdrawal Fee (Bank Transfer) | 0% - 1% |

4. Bybit - Great UI Design

Trading Fees

0.0675% - 0.1200%

Supported Crypto

462+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR, NZD + 160 others Some through third party apps.

Not AUSTRAC Registered This exchange is not registered with AUSTRAC, proceed with caution if you are Australian. Digital currency exchange providers in Australia are required to be registered with AUSTRAC. This ensures they must comply with relevant AML and CTF laws or risk facing heavy penalties. You can read more about this on AUSTRAC's website.

ByBit is selected for its intuitive platform and rapid growth since its launch in 2018, making it a noteworthy player in the cryptocurrency exchange arena.

The exchange’s wide variety of digital assets, coupled with a user-friendly interface, caters well to both new and experienced traders. ByBit’s commitment to high-speed, reliable trading infrastructure and robust security measures ensures a safe and seamless trading experience.

Additionally, the responsive customer support further enhances its appeal, making ByBit a preferred choice for a broad range users.

ByBit, established in 2018, has quickly become one of the biggest cryptocurrency exchanges on the global stage. Known for its intuitive user interface, ByBit is designed to cater to both newcomers and experienced traders in the cryptocurrency market.

One of ByBit’s standout features is its commitment to providing a seamless trading experience. The platform supports a wide range of cryptocurrencies, ensuring users have access to various digital assets. ByBit’s infrastructure is also noted for its speed and reliability, offering a stable environment for cryptocurrency trading.

Regarding deposits and withdrawals, ByBit provides multiple options to suit diverse user preferences. This means it’s very straightforward for users to manage their digital assets.

Security is a top priority for ByBit. The platform employs advanced security measures to protect user accounts and assets. This focus on security helps in building user trust and ensures a safe trading environment.

Furthermore, ByBit is known for its customer support. The exchange has a responsive support team that is available to assist users with any queries or issues they may encounter.

While ByBit offers a range of features and tools that may appeal to a broad audience, users are encouraged to conduct their research and consider their individual needs when choosing a cryptocurrency exchange.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | 0% |

| Deposit Fee (Credit/Debit Card) | 0% |

| Trading Fee | 0.0675% - 0.1200% |

| Withdrawal Fee (Bank Transfer) | 0% |

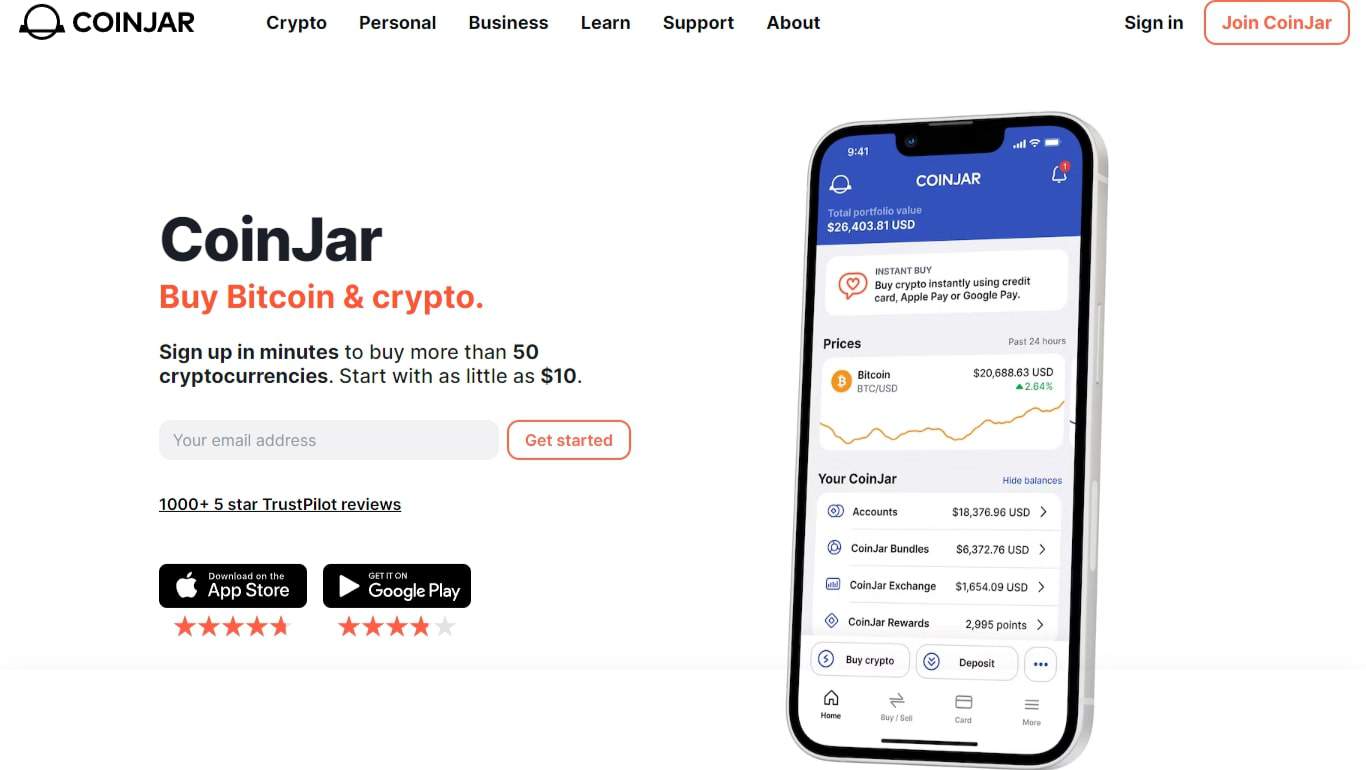

5. CoinJar - Longest-standing Australian Cryptocurrency Exchange

Trading Fees

0.02% - 0.10%

Supported Crypto

68+

Supported Fiat Currencies

USD, AUD, GBP, EUR

AUSTRAC Registered This exchange is registered with AUSTRAC. Digital currency exchange providers in Australia are required to be registered with AUSTRAC. This ensures they must comply with relevant AML and CTF laws or risk facing heavy penalties. You can read more about this on AUSTRAC's website. This registration should not be viewed as an official endorsement or guarantee of services.

CoinJar, a pioneer in the Australian cryptocurrency exchange market since 2013, has been selected for its enduring presence and innovative expansions, including its venture into the UK market.

The exchange is commended for its technological advancements, notably the CoinJar card, which integrates cryptocurrency with everyday transactions. Despite a more limited selection of cryptocurrencies, CoinJar offers diverse deposit methods, including unique options like Blueshyft cash deposits, and supports multiple fiat currencies for trading and withdrawals.

The CoinJar Bundles feature is particularly appealing for beginners, providing an accessible way to diversify crypto holdings.

CoinJar was the first crypto exchange to be launched in Australia back in 2013. It’s impressive how they have stood the test of time and expanded overseas. The exchange was originally headquartered in Melbourne, Australia, and then registered as a UK crypto exchange a year later.

CoinJar has been at the forefront of many great technological advancements including the CoinJar card (powered by Mastercard) that allows you to spend your crypto like cash.

However, it’s worth pointing out that the exchange has a limited amount of cryptocurrencies it supports compared to some exchanges featured on this list but they do allow a huge range of deposit methods including Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Osko, PayID, Apple Pay, Google Pay, Faster Payments, Blueshyft, Google Pay, Apple Pay, EML. Currently, they support USD, AUD, GBP, EUR.

CoinJar Bundles allows you to choose a bundle of cryptocurrencies that you can regularly buy to get exposure to a number of different cryptos. It’s an innovative feature that traders love based on reviews.

The fees however, are higher than it’s competitors which is one of the main drawbacks, with 0.02% - 0.10% fees, many users prefer other Australian exchanges.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer - Osko, PayID) | 0% |

| Deposit Fee (Credit/Debit Card) | 2% |

| Trading Fee | 0.02% - 0.10% |

| Withdrawal Fee (Bank Transfer) | 0% |

6. Independent Reserve - Best Exchange for NZ

Trading Fees

0.26% - 0.50%

Supported Crypto

29+

Supported Fiat Currencies

USD, AUD, NZD + 1 other

AUSTRAC Registered This exchange is registered with AUSTRAC. Digital currency exchange providers in Australia are required to be registered with AUSTRAC. This ensures they must comply with relevant AML and CTF laws or risk facing heavy penalties. You can read more about this on AUSTRAC's website. This registration should not be viewed as an official endorsement or guarantee of services.

Independent Reserve is selected for its reputation as a dependable and veteran player in the Australian cryptocurrency scene.

The exchange offers a broad array of payment methods, catering specifically to Australian users, and supports a wide range of currencies, making it versatile for international transactions. Its competitive fee structure is attractive, particularly for those with higher trade volumes.

A standout feature is the option of a premium account offering full insurance on crypto holdings, showcasing its commitment to security with measures like multi-layer encryption and cold storage. While it presents a slight learning curve, Independent Reserve is highly recommended for more experienced traders, owing to its robust features and secure trading environment.

The next crypto exchange on our list, Independent Reserve, is also native to Australia, and based on user reviews, it has proven itself to be a reliable platform for crypto trading over the years.

Independent Reserve is a veteran of the Australian crypto scene but supports a smaller range of cryptocurrencies.

For Australians the exchange has a great range of payment methods such as Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Osko, PayID, Paypal.

You can use USD, AUD, NZD + 1 other on the platform. Compared to other exchanges of this type, Independent Reserves fees are competitive at 0.26% - 0.50% depending on trade volume.

Using a premium account allows full insurance on your crypto holdings. Namely, this upgrade ensures guaranteed protection of accounts against a breach of the exchange’s security, employee theft, or any loss of funds from your crypto wallet on the platform.

Moreover, Independent Reserve uses offline, multi-layer encryption for your funds and stores them in cold storage, i.e., offline digital hardware storage devices kept in secure vaults in different locations.

The exchange isn’t perfect for beginners as there is a slight learning curve to it compared to other exchanges, so we recommend it to more experienced traders.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer - Osko, PayID) | $0 - $15 |

| Deposit Fee (Credit/Debit Card) | $0 - $15 |

| Trading Fee | 0.26% - 0.50% |

| Withdrawal Fee (Bank Transfer) | 0% - $25 |

7. Crypto.com - Best for Mobile App Trading

Trading Fees

0.07% - 0.08%

Supported Crypto

358+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR, NZD + 19 others Some through third party apps.

Not AUSTRAC Registered This exchange is not registered with AUSTRAC, proceed with caution if you are Australian. Digital currency exchange providers in Australia are required to be registered with AUSTRAC. This ensures they must comply with relevant AML and CTF laws or risk facing heavy penalties. You can read more about this on AUSTRAC's website.

Crypto.com is chosen for its versatility and rich feature set, available on both desktop and mobile platforms. It stands out with its expansive offering of cryptocurrencies, NFT marketplace, and additional features.

A key advantage is the platform’s own cryptocurrency, CRO, which allows users to reduce trading fees and earn rewards. While some features are currently limited for Australian users, Crypto.com remains a competitive option for its comprehensive trading platform and excellent customer support.

The exchange offers live chat support and an efficient email ticketing system but it isn’t reliable during busy periods, making it a noteworthy option for crypto traders, despite some limitations for Australian users.

Crypto.com is a great crypto trading platform that is available on both desktop and mobile. Not only can you buy and sell digital assets, but there are also a lot of extra features like the NFT marketplace, Visa debit card, earning, and staking (read on for more information about this since it’s limited for Australians).

One of the main reasons why Crypto.com is popular is because it offers more than 358+ crypto coins that users can buy, sell, or trade. Crypto.com has it’s own cryptocurrency. the good thing about CRO is that you can stake it to reduce trading fees, earn rewards, and provide cash back on purchases via a Visa debit card.

Crypto.com offers a wide range of features including its staking and earn feature, however for Australian users most of this isn’t available. It’s worth mentioning since these might become available in the future. However, at this stage, we don’t think that will happen.

For Australians there are many better options than Crypto.com at this time due to their limited offerings, however, their crypto trading platform is still competitive and worth considering.

Crypto.com comes with excellent customer support. The best part is that they have live chat support ready to help you any time of the day. The downside is that in busy periods, your chat will be replied to by email at a later point.

Overall, Crypto.com’s support team is pretty responsive, depending on how busy they are. Their email ticketing system is also good if you’re not in a rush. But there are better options in terms of support for Aussies.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | 0% |

| Deposit Fee (Credit/Debit Card) | 2.99% |

| Trading Fee | 0.07% - 0.08% |

| Withdrawal Fee (Bank Transfer) | 0% |

8. Coinbase - Biggest International Exchange for Beginners

Trading Fees

0% - 0.60%

Supported Crypto

243+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR, NZD + 50 others

AUSTRAC Registered This exchange is registered with AUSTRAC. Digital currency exchange providers in Australia are required to be registered with AUSTRAC. This ensures they must comply with relevant AML and CTF laws or risk facing heavy penalties. You can read more about this on AUSTRAC's website. This registration should not be viewed as an official endorsement or guarantee of services.

Coinbase is recognized for its strong global presence and adherence to strict regulatory standards, offering a secure and user-friendly platform ideal for beginners.

It supports a wide range of cryptocurrencies and offers diverse payment methods to suit different trading styles. Coinbase has become more competitive with its fee structure making it a more attractive choice.

Despite better local options for Australian users, Coinbase’s commitment to security and its reputation as a trustworthy international exchange make it a notable choice in the cryptocurrency market.

Coinbase is one of the most mainstream crypto brands on the international stage. This American-based brokerage service was launched in 2012 and since then, it’s followed a highly regulated sequence of growth.

Coinbase is registered as a Money Services Business with FinCEN and has obtained numerous licenses from reliable financial regulators including AUSTRAC in Australia.

Coinbase can be a great choice for crypto traders, especially beginners, due to its user-friendliness and easily navigable interface. They support an insane amount of cryptocurrencies as well, which didn’t used to be the case.

Coinbase has a strict Digital Asset Framework that assesses each currency’s metrics (e.g. market capitalisation, liquidity, customer demand, velocity) before deciding whether to add support for that coin or not.

Another Coinbase feature that many users appreciate is the variety of payment methods. Thus, you can choose to pay with a debit card for small investments, wire transfer for large investments, or bank account for either.

One of the biggest drawbacks for Coinbase has always been its high fees, but this is no longer the case, they’ve made their fees much more competitive at 0% - 0.60% based on trade volume. The platform also offers superb account protection. They support three types of 2FA available, a withdrawal whitelist, a Coinbase wallet, and a vault during the registration process.

With Coinbase you get a sense of security and sophistication, but for Australian users there are much better local options.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | $0 - $10 |

| Deposit Fee (Credit/Debit Card) | $0 - $10 |

| Trading Fee | 0% - 0.60% |

| Withdrawal Fee (Bank Transfer) | $0 - $25 |

9. Coinmama - International Crypto Broker with Great Payment Options

Trading Fees

0.99% - 3.90%

Supported Crypto

86+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR, NZD + 180 others Some through third party apps.

Not AUSTRAC Registered This exchange is not registered with AUSTRAC, proceed with caution if you are Australian. Digital currency exchange providers in Australia are required to be registered with AUSTRAC. This ensures they must comply with relevant AML and CTF laws or risk facing heavy penalties. You can read more about this on AUSTRAC's website.

Coinmama, established in 2013, stands out for its user-friendly approach, catering especially to beginners with its simple spot trading platform.

The exchange’s ease of use is its main appeal, allowing straightforward purchases of a variety of cryptocurrencies. While customer support is comprehensive, including support tickets and live chat, it may not align well with Australian time zones.

Despite its higher fees and a more limited range of cryptocurrencies, Coinmama’s strong international presence and large global customer base make it a noteworthy option for those who value simplicity in their crypto transactions.

This exchange has been around since 2013 and has grown into a well-known and reliable platform. Coinmama is quite different to most other exchanges.

The exchange only offers spot trading and doesn’t allow trading in an open market between buyers and sellers. As a result, their platform is very easy to use and allows users to pruchase a range of cryptocurrencies quite easily. In this case they’ve gone for simplicity, focusing on beginners.

They also have good customer support, with options such as support tickets, email, and live chat (during business hours only). However, for Australians the support isn’t great because the timing with live chat doesn’t line up well.

Coinmama is mainly an international exchange, supporting over 180 countries and has millions of satisfied customers. One of the biggest drawbacks for the platform is their fees. On the top end they have one of the highest fees in the industry, especially for a global exchange.

The platform isn’t very transparent about their fees and they also charge a service fee on most trades which can be very high. It also doesn’t support many cryptocurrencies compared to most of it’s competitors.

All in all, the exchange is competitive globally but it’s not great for Australians.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | 0% |

| Deposit Fee (Credit/Debit Card) | 4.50% - 6.50% |

| Trading Fee | 0.99% - 3.90% |

| Withdrawal Fee (Bank Transfer) | 0.10% - 0.90% |

10. eToro - Best for Trading Options

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

eToro Service ARSN 637 489 466 Capital at risk. See PDS and TMD.

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

Trading Fees

1%

Supported Crypto

96+

Supported Fiat Currencies

USD

AUSTRAC Registered This exchange is registered with AUSTRAC. Digital currency exchange providers in Australia are required to be registered with AUSTRAC. This ensures they must comply with relevant AML and CTF laws or risk facing heavy penalties. You can read more about this on AUSTRAC's website. This registration should not be viewed as an official endorsement or guarantee of services.

eToro is chosen for its exceptional versatility and user-friendly platform, catering to a wide audience since 2006.

Its commitment to robust security measures, including two-factor authentication and regular audits, provides a secure trading environment.

eToro has great features and supports a decent amount of cryptocurrencies, the biggest glaring problem is its high fees.

While it offers diverse trading opportunities, its suitability depends on individual trading needs and expertise, making it an exchange worth considering for a broad spectrum of traders, from beginners to experienced investors.

Pros

Cons

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

eToro Service ARSN 637 489 466 Capital at risk. See PDS and TMD.

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

Founded in 2007, eToro is a multi-asset company that knows how to keep users busy with 2,000+ trading products including securities, ETFs, stocks, cryptocurrencies and much more.

In terms of crypto trading, it’s a solid platform that supports a decent amount of cryptocurrencies. They also have some advanced features that are very well known like the copy-trading functionality allowing you to mimic the trading strategies of other users.

eToro excels in its user-friendliness and robust security measures. The platform is designed to cater to both beginners and experienced traders, with an interface that balances simplicity with advanced functionality.

Security on eToro is taken seriously, with the platform employing advanced protocols to safeguard users’ funds and personal information. This includes measures such as two-factor authentication (2FA), encryption, and regular security audits, ensuring a secure trading environment.

eToro has one of the highest fees on the market, but it’s also a much larger platform than most of its competitors for a variety of different assets.

In Australia, eToro is licensed by the Australian Securities Investment Commission (ASIC) under the trading name eToro AUS Capital Pty Ltd. As for customer support, they have both a live chat feature and support tickets available for direct communication.

It’s important to note that while eToro offers a broad spectrum of trading opportunities, the platform may not be the best fit for every trader. Users should consider their specific trading needs and expertise level before choosing eToro.

In summary, eToro’s combination of user-friendly design, innovative features, and strong security protocols positions it as a versatile and reliable choice for a broad range of traders, from novices to seasoned investors.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | 0% |

| Deposit Fee (Debit Card) | 0% |

| Trading Fee | 1% |

| Withdrawal Fee (Bank Transfer) | 0% - $5 USD |

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Smart Portfolios are not exchange-traded funds or hedge funds and are not tailored to your specific objectives, financial situations, and needs. Your capital is at risk. See PDS and TMD.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk. May not suffice as a basis for investment decisions.

How to Choose the Best Crypto Exchange

Selecting the right cryptocurrency exchange is a crucial step in your trading and investment journey. With a plethora of options available, it’s important to consider several key factors to ensure that the exchange you choose meets your needs and expectations. Here are some essential aspects to consider:

- User Interface and Experience: A user-friendly interface is vital, especially for beginners. Look for an exchange with an intuitive design that makes it easy to navigate, perform trades, and access essential features. A cluttered or complex interface can lead to errors and a frustrating experience.

- Security Measures: Security should be your top priority. Opt for exchanges that employ robust security protocols like two-factor authentication (2FA), encryption, and cold storage for digital assets. Also, check if they have a history of security breaches and how they were handled.

- Range of Cryptocurrencies: Consider the variety of cryptocurrencies available for trading. While some traders might be looking to trade popular coins like Bitcoin and Ethereum, others might be interested in a wider range of altcoins or emerging tokens.

- Regulatory Compliance: Ensure that the exchange complies with local regulations, including anti-money laundering (AML) and know your customer (KYC) policies. This compliance not only speaks to the legitimacy of the exchange but also ensures a certain level of user protection.

- Fee Structure: Understand the fee structure of the exchange. This includes trading fees, withdrawal fees, and any other hidden costs. Compare the fees across different platforms to ensure you’re getting a fair deal.

- Customer Support: Good customer support can be a lifesaver, especially in fast-moving markets. Look for exchanges that offer prompt and helpful support, ideally through multiple channels like email, chat, and phone.

- Liquidity: High liquidity means you can buy and sell assets without significantly affecting the market price. An exchange with good liquidity typically provides better price discovery and faster transactions.

- Payment Methods: Consider the payment methods available for depositing fiat currency. More options provide greater flexibility, but it’s also important to check for any associated fees and processing times.

- Educational Resources: Especially for new traders, having access to educational materials and resources can be highly beneficial. Some exchanges offer tutorials, articles, and even webinars to help users understand the market and trading strategies.

- Reputation and Reviews: Do your due diligence by researching the exchange’s reputation. Look for user reviews, expert opinions, and any news related to the platform’s performance and reliability.

Remember, no single exchange will be perfect in all aspects. It’s about finding the right balance that suits your individual trading style, experience level, and security requirements.

Final Thoughts

Each platform we’ve reviewed brings its unique strengths and offerings to the table, catering to a diverse range of needs and preferences.

From user-friendly interfaces ideal for beginners to advanced trading features for seasoned investors, the Australian crypto market presents a variety of options to suit different trading styles. Security, range of cryptocurrencies, fee structures, customer support, and regulatory compliance remain key factors in determining the right exchange for you.

It’s important to remember that the world of cryptocurrency is ever-changing, with new technologies and regulations continuously shaping the landscape. Therefore, staying informed and adaptable is crucial in this dynamic market.

Our guide aims to provide you with a comprehensive overview, but we encourage you to continue your research and stay updated with the latest developments in the crypto world. Whether you are making your first foray into cryptocurrencies or looking to diversify your trading platforms, we hope our reviews and insights have been valuable in guiding your decision.

In conclusion, the best cryptocurrency exchange for you is one that aligns with your specific needs, investment goals, and security expectations. As the Australian cryptocurrency scene continues to evolve, we are excited to see how these platforms will grow and innovate to meet the demands of an increasingly digital world.

FAQs

The “safest” Australian crypto exchange can vary based on individual security needs and preferences. However, exchanges like Swyftx, CoinSpot and Independent Reserve are often highlighted for their strong security measures.

They both comply with Australian laws and regulations, offering features like two-factor authentication, cold storage of assets, and insurance on funds held.

It’s important to research and compare the security features of each exchange to determine what suits your requirements best.

Choosing between Swyftx and CoinSpot depends on your specific needs and preferences. Swyftx is known for its user-friendly interface and low spreads, making it appealing for beginners and regular traders.

CoinSpot, on the other hand, is praised for its wide range of supported cryptocurrencies and strong security measures. Both exchanges are compliant with Australian regulations.

For ease of use, especially for beginners, Swyftx is often recommended due to its straightforward and user-friendly interface.

It offers a simple layout, clear transaction processes, and easy navigation, making it accessible for users new to cryptocurrency trading.

Storing crypto on Swyftx is generally considered safe, as the platform employs various security measures like two-factor authentication, biometric logins, and cold storage for the majority of assets.

However, like with any online exchange, there is always some level of risk involved. For enhanced security, it is often recommended to store large amounts of cryptocurrencies in a hardware wallet, which provides an extra layer of security by keeping your assets offline.

Methodology

Our team employs a rigorous rating process, analysing various criteria to determine our star rating system. This system allows us to condense our extensive research into an easy-to-understand format. For a deeper dive into our rating process, check out our full methodology.

We assess crypto exchanges based on the following criteria:

- Platform Usability: How user-friendly is the platform for beginners? What advanced tooling and charting features are available for seasoned traders?

- Supported Cryptocurrencies: What's the range of supported cryptocurrencies, and how frequently does the exchange add new ones?

- Supported Fiat Currencies: How many fiat currencies are supported? Are the banking relationships direct or through third parties?

- Deposit and Withdrawal Methods: Are there diverse methods for account funding and withdrawals?

- Fees: How competitive are the trading, deposits, and withdrawal fees? Is the exchange known for adding large spreads to conversions?

- Customer Support: How accessible and helpful is the customer support team? Are multiple support methods available?

- Exchange Activity: How proactive is the exchange in terms of updates? Is their social media presence active, and do they engage with the community regularly?

- Security: What security measures are in place to safeguard users, such as Two-Factor Authentication (2FA), relevant certifications and general security processes? If the exchange has experienced significant hacks, how have they addressed and evolved from those incidents?

- Regulatory Registrations: Does the exchange meet the necessary regulatory requirements to operate in Australia?