In the rapidly evolving world of cryptocurrency, decentralized exchanges (DEXs) have emerged as a core part of the ecosystem, offering an alternative to traditional centralized platforms.

These exchanges empower users with greater control over their assets, enhanced security, and a trustless environment that aligns seamlessly with the core principles of blockchain technology.

In this guide, we meticulously explore the top decentralized crypto exchanges, delving into their unique features, advantages, and why they stand out in the crowded landscape of digital currency trading.

Our selection criteria are rigorous, focusing on aspects such as user autonomy, security measures, ease of use, the range of available cryptocurrencies, and innovative features like advanced trading options, liquidity provision, and community-driven governance.

Best Decentralized Crypto Exchanges for 2024

- Best for Optimized Trade Routing: 1inch

- Best for Multi-Chain Trading Options: OKX

- Best for Reduced Impermanent Loss: Bancor Network

- Best for High-Performance Decentralized Trading: IDEX

- Best for Altcoin Variety: PancakeSwap

- Best for Automated Liquidity Provision: Uniswap

- Best for Trading Options: dYdX

Why Trust Crypto Head

We have been committed to providing our readers with well-researched, unbiased, and reliable information since 2017. Our team consists of crypto experts who understand the importance of choosing the right exchange.

We have spent a huge amount of time over the years evaluating and comparing a range of crypto platforms. We use a rigorous methodology to evaluate each platform, considering factors like security, user experience, and fees.

226

Exchanges considered

141

Exchanges analysed

9,165

Data points collected

1. 1inch - Best for Optimized Trade Routing

Trading Fees

0%

Supported Crypto

267+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR + 10 others Only supports fiat currencies through third party apps.

1inch is chosen for its innovative approach as a decentralized exchange aggregator, making it a standout choice in the realm of decentralized cryptocurrency exchanges. Launched in 2019, 1inch excels in offering users the best possible trade prices by aggregating liquidity from various decentralized exchanges (DEXs).

The platform’s use of smart contract technology to optimize trading routes across multiple DEXs ensures users receive efficient and cost-effective trading experiences. This, combined with its user-friendly interface and commitment to minimizing transaction fees, makes 1inch a top choice for those seeking a decentralized trading solution.

1inch offers a unique and advanced trading experience by aggregating liquidity from multiple decentralized exchanges. This approach allows users in the decentralized finance (DeFi) space to execute trades at the most favorable rates available across a wide network of DEXs.

The platform utilizes sophisticated algorithms to determine the best trading routes, helping users minimize slippage and reduce transaction costs. This feature is particularly beneficial for larger trades, where price impact can be a significant concern.

1inch’s interface balances simplicity and functionality, making it accessible to both experienced DeFi users and those newer to decentralized trading. The platform also supports a variety of wallets for easy integration and use.

In terms of fees, 1inch strives to keep transaction costs low, which is a key advantage in the DeFi space where gas fees can sometimes be prohibitive. The platform also implements measures to protect users from front-running and other potential risks associated with decentralized trading.

As a decentralized platform, 1inch places a strong emphasis on user autonomy and security. Users have full control over their funds and transactions, with the smart contract technology ensuring transparency and security.

Customer support is primarily community-driven, with resources like user guides, FAQs, and active community forums available to assist users. This approach fosters a collaborative and supportive environment within the 1inch ecosystem.

| Type | Fee |

|---|---|

| Trading Fee | 0% |

2. OKX - Best for Multi-Chain Trading Options

Trading Fees

0.08% - 0.10%

Supported Crypto

320+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR, NZD + 85 others Some through third party apps.

OKX, formerly known as OKEx, is selected for its unique position in offering both centralized and decentralized trading options, catering to a diverse range of preferences within the crypto community. This dual approach positions OKX as a versatile choice in the list of best decentralized crypto exchanges.

The platform stands out for its decentralized exchange (DEX) feature, which offers users the autonomy and security of decentralized trading while still providing access to the liquidity and advanced features of a centralized platform. OKX’s commitment to innovation and user security makes it a notable option for those seeking the flexibility of both decentralized and centralized trading experiences.

OKX offers a comprehensive trading experience, combining the benefits of both decentralized and centralized exchange features. Its DEX component allows users to engage in decentralized trading, maintaining control over their private keys and assets.

The platform’s decentralized exchange is designed to offer a seamless trading experience, with an intuitive interface and access to a wide range of cryptocurrencies. This setup is ideal for users who prioritize the security and privacy aspects of decentralized trading.

In addition to standard DEX features, OKX provides advanced trading options typically found in centralized exchanges. This blend of offerings caters to a broad spectrum of trading strategies and preferences.

Security on OKX’s decentralized platform is robust, with users having full custody of their funds, reducing the risk of central points of failure. The platform employs advanced security protocols to ensure the safety and integrity of transactions.

While OKX’s decentralized exchange offers a high degree of autonomy and security, it’s important to note that the level of customer support and ease of use may differ from what users experience on the centralized portion of the platform.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | Depends On the Country |

| Deposit Fee (Credit/Debit Card) | 0% |

| Trading Fee | 0.08% - 0.10% |

| Withdrawal Fee (Bank Transfer) | 0% via P2P |

3. Bancor Network - Best for Reduced Impermanent Loss

Trading Fees

0.1%

Supported Crypto

239+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR, NZD + 70 others Some through third party apps.

Bancor Network is chosen for its pioneering role in decentralized exchange technology and its unique approach to liquidity provision. As one of the first projects to introduce automated market makers (AMMs) in the DeFi space, Bancor has become a key player in the realm of decentralized exchanges.

The platform stands out for its innovative liquidity pool model, which allows users to provide liquidity with single-asset exposure, reducing the risk of impermanent loss. Bancor’s focus on user-friendly liquidity provision and its integrated token, BNT, make it a compelling choice for those interested in participating in the DeFi ecosystem without the complexities often associated with it.

Bancor Network offers a decentralized trading experience centered around its AMM protocol. The platform allows users to trade a variety of cryptocurrencies directly from their wallets, bypassing the need for traditional order books.

A distinctive feature of Bancor is its single-asset liquidity provision, which allows users to contribute to liquidity pools without needing to provide a corresponding pair of assets. This simplifies the liquidity provision process and reduces the risk of impermanent loss, a common issue in traditional liquidity pools.

The platform’s native token, BNT, plays a crucial role in the Bancor ecosystem, facilitating trades and offering users voting rights in governance decisions, further emphasizing its decentralized nature.

Bancor’s user interface is designed to be intuitive and accessible, catering to both experienced DeFi users and those new to decentralized exchanges. The platform also provides detailed analytics on liquidity pools and trading activities, aiding users in making informed decisions.

In terms of security, Bancor employs smart contracts audited by reputable firms, ensuring a high level of trust and safety in its operations. However, as with all decentralized platforms, users are encouraged to exercise caution and understand the associated risks.

While Bancor offers a high degree of autonomy and innovative features, it’s important to note that support options may be more limited compared to centralized exchanges. User support is primarily community-based, with resources available through forums and social media channels.

| Type | Fee |

|---|---|

| Trading Fee | 0.1% |

4. IDEX - Best for High-Performance Decentralized Trading

Trading Fees

0.13%

Supported Crypto

26+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR, NZD + 30 others Only supports fiat currencies through third party apps.

IDEX is selected for its unique blend of decentralized and centralized exchange features, offering a hybrid trading experience that stands out in the decentralized crypto exchange market. Launched in 2017, IDEX provides the security and privacy benefits of a decentralized exchange while incorporating elements of centralization to enhance user experience and order matching efficiency.

This hybrid approach allows for real-time trading and high transaction throughput, addressing some of the common limitations of traditional DEXs. IDEX’s focus on combining the best aspects of both decentralized and centralized systems makes it a compelling option for traders seeking both security and efficiency.

IDEX offers a unique trading platform that combines decentralized security with centralized speed and user experience. This hybrid model allows users to experience the benefits of both worlds, making it an attractive option for those seeking a more efficient decentralized trading experience.

The platform enables real-time trading, which is a significant advantage over many DEXs that can be slower due to their reliance on blockchain confirmations for each transaction. IDEX achieves this by managing the order book and trade execution off-chain, while still ensuring that assets are held securely in smart contracts.

IDEX’s user interface is designed to be familiar to those who have used centralized exchanges, offering an intuitive and straightforward experience. This ease of use does not come at the expense of security, as users retain control of their private keys and funds throughout the trading process.

Transaction fees on IDEX are competitive, and the platform employs a maker-taker fee model, which incentivizes liquidity provision. This model benefits both high-volume traders and casual users alike.

As for security, IDEX emphasizes the safekeeping of user funds. The platform utilizes smart contracts for all trades, ensuring that users remain in control of their assets until the point of exchange.

Customer support on IDEX includes a comprehensive help center and responsive support team, providing users with assistance and ensuring a smooth trading experience.

| Type | Fee |

|---|---|

| Trading Fee | 0.13% |

5. PancakeSwap - Best for Altcoin Variety

Trading Fees

0.25%

Supported Crypto

1647+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR + 7 others Some through third party apps.

PancakeSwap is chosen for its leading position in the decentralized finance (DeFi) space, particularly within the Binance Smart Chain (BSC) ecosystem. As one of the most popular automated market makers (AMMs) on BSC, PancakeSwap offers a user-friendly interface, low transaction fees, and a wide array of DeFi services.

The platform stands out for its innovative features, including yield farming, staking, and a lottery system, along with its vast range of liquidity pools. PancakeSwap’s commitment to community-driven development and its playful branding make it a unique and engaging option for users interested in decentralized exchange and DeFi activities.

PancakeSwap offers a comprehensive DeFi experience, providing users with not just a decentralized exchange platform but also various additional DeFi services. The platform operates on the Binance Smart Chain, which allows for faster transactions and lower fees compared to networks like Ethereum.

Users can swap between a vast array of tokens, provide liquidity to pools, and engage in yield farming, all within a decentralized and user-controlled environment. PancakeSwap’s liquidity pools offer competitive yields, making it an attractive platform for those looking to earn passive income through DeFi activities.

A unique aspect of PancakeSwap is its community-focused features, such as the CAKE token that grants governance rights and the ability to participate in yield farming. The platform also hosts a lottery and NFT collectibles, adding an element of fun and engagement to the DeFi experience.

Security is a critical aspect of PancakeSwap, with the platform undergoing regular audits and updates to ensure the safety of user funds. However, as with all decentralized platforms, users should exercise due diligence and understand the risks involved in DeFi.

Customer support is primarily community-driven, with active social media channels and user forums where members can seek assistance and share information. This approach fosters a strong sense of community but may differ from the direct support services offered by centralized exchanges.

| Type | Fee |

|---|---|

| Trading Fee | 0.25% |

6. Uniswap - Best for Automated Liquidity Provision

Trading Fees

0.30%

Supported Crypto

1786+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR, NZD + 33 others Only supports fiat currencies through third party apps.

Uniswap is selected for its status as one of the most prominent and user-friendly decentralized exchanges (DEXs) in the cryptocurrency space. Launched in 2018, Uniswap has become synonymous with the DeFi movement, known for its automated market maker (AMM) protocol that facilitates seamless token swaps without the need for traditional order books.

The platform’s simplicity, combined with its permissionless nature and trustless trading environment, makes it a go-to choice for Ethereum-based token trading. Uniswap’s significant liquidity, wide token availability, and commitment to decentralization are key factors in its selection as a top decentralized crypto exchange.

Uniswap offers a straightforward and efficient way to trade Ethereum and ERC-20 tokens in a decentralized manner. The platform operates on an AMM model, where liquidity pools replace traditional market-making mechanisms, allowing for instant and permissionless trades.

One of the key advantages of Uniswap is its open and inclusive nature. Anyone can provide liquidity to the pools and earn fees from the trades that occur within their pool, democratizing the process of market making and earning from crypto assets.

Uniswap’s interface is intuitive and user-friendly, making it accessible even for those who are new to the world of DeFi and decentralized trading. The platform supports a wide range of Ethereum-based tokens, providing users with a vast array of trading options.

In terms of fees, Uniswap charges a flat trading fee, a portion of which is distributed to liquidity providers as an incentive. This fee structure is transparent and competitive within the DeFi space.

Security on Uniswap is a high priority, with the platform utilizing smart contracts for all trades. However, users should be aware of the risks inherent in DeFi and smart contract-based systems, including potential vulnerabilities and impermanent loss for liquidity providers.

Customer support is primarily community-driven, with resources like forums, FAQs, and active social media channels where users can seek assistance and share insights.

| Type | Fee |

|---|---|

| Trading Fee | 0.30% |

7. dYdX - Best for Trading Options

Trading Fees

0.02% - 0.04%

Supported Crypto

37+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR + 26 others Only supports fiat currencies through third party apps.

dYdX is selected for its cutting-edge approach to decentralized trading, making it a standout platform in the decentralized exchange (DEX) landscape. Established as a leading DeFi platform, dYdX offers advanced financial instruments, all within a decentralized framework.

The platform is particularly appealing for its integration of advanced trading features typically found in traditional finance, combined with the security and transparency of blockchain technology. dYdX’s focus on providing a sophisticated trading experience while maintaining decentralization makes it a top choice for experienced traders in the DeFi space.

dYdX offers a comprehensive decentralized trading experience, primarily focusing on derivatives, which are not commonly found on traditional DEXs. This positions dYdX as a unique platform for users seeking more advanced trading options in a decentralized environment.

The platform provides an interface that is both powerful and user-friendly, catering to traders who require detailed analysis and the ability to execute complex trading strategies.

In terms of fees, dYdX operates with a competitive structure, charging fees based on the trade’s size. These fees are used to incentivize liquidity providers and ensure the smooth operation of the platform.

Security is a critical aspect of dYdX, with the platform leveraging smart contracts for decentralized trade execution and custody. This setup ensures that users have full control over their funds while engaging in complex trading activities.

As with most decentralized platforms, customer support on dYdX is mainly community-based, with resources such as documentation, FAQs, and community forums. While this fosters a strong sense of community engagement, users may not have access to immediate, personalized customer service.

| Type | Fee |

|---|---|

| Trading Fee | 0.02% - 0.04% |

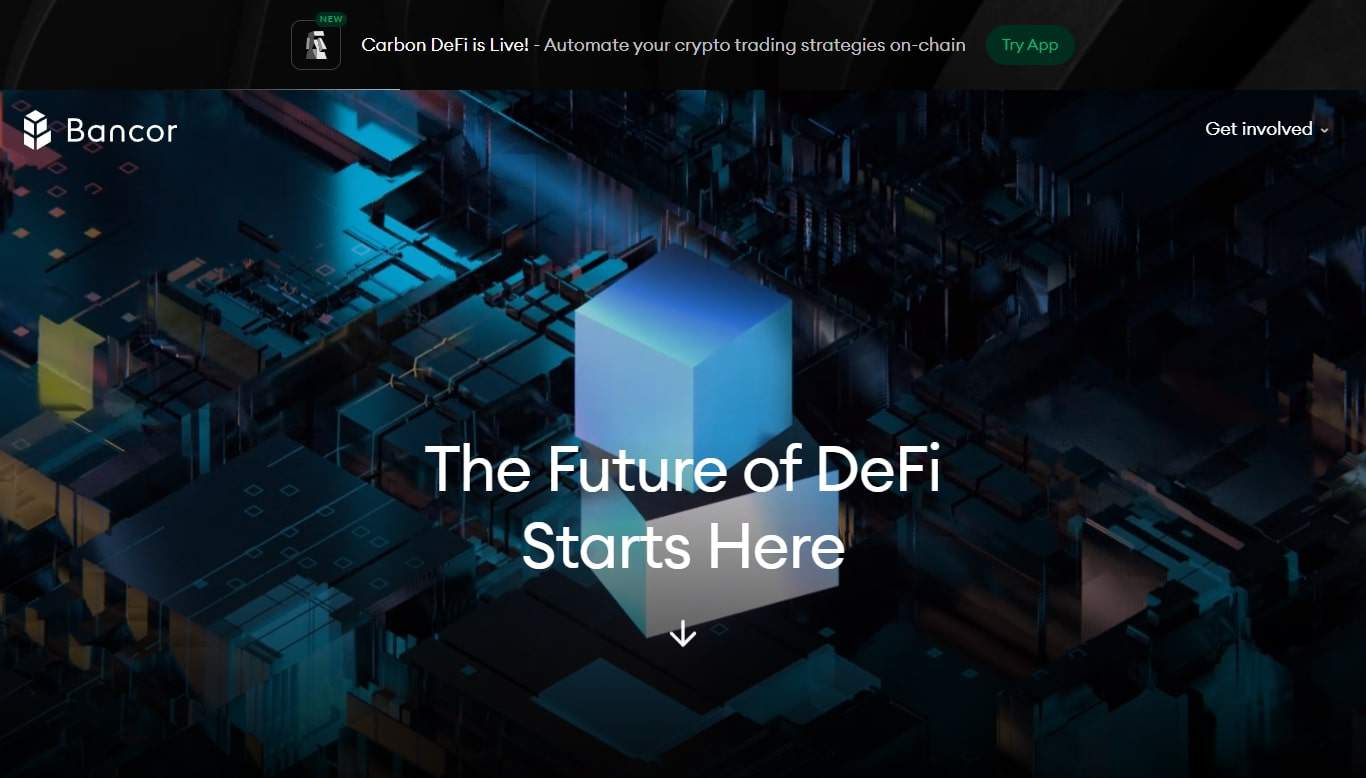

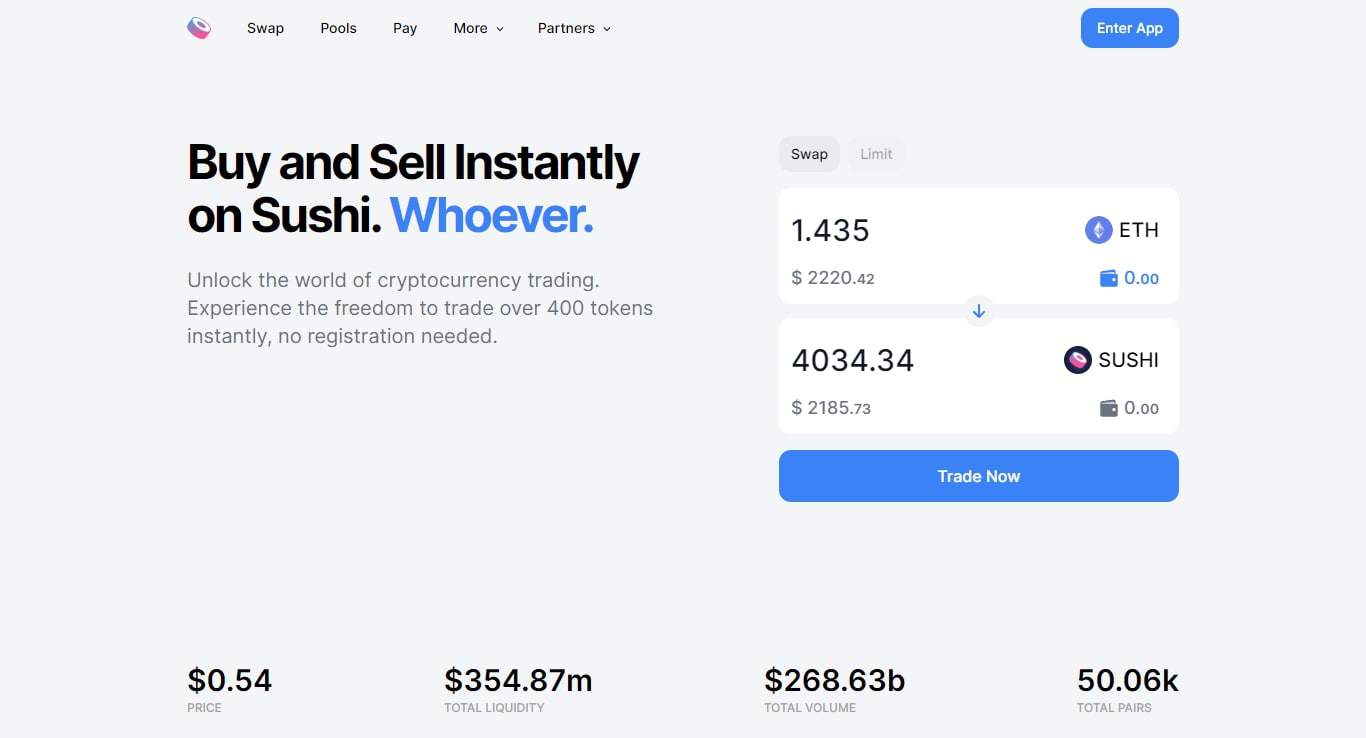

8. SushiSwap - Best for Community-Driven Features

Trading Fees

0.30%

Supported Crypto

289+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR, NZD + 70 others Only supports fiat currencies through third party apps.

SushiSwap is chosen for its significant contributions to the decentralized finance (DeFi) sector, particularly as a decentralized exchange (DEX) and automated market maker (AMM). Originating as a fork of Uniswap, SushiSwap has established itself with unique features like SushiBar, Onsen, and a community-driven governance model, appealing to users seeking a decentralized and participatory trading platform.

SushiSwap stands out for its user-friendly liquidity provision, yield farming opportunities, and the integration of a native governance token, SUSHI, which allows users to participate in key decision-making processes. Its innovative approach to DeFi services and commitment to community involvement make it a popular choice in the decentralized exchange space.

SushiSwap offers a comprehensive DeFi experience, allowing users to engage in decentralized trading, liquidity provision, and yield farming. As an AMM, SushiSwap enables users to trade cryptocurrencies directly from their wallets without relying on traditional order books, providing a seamless and secure trading experience.

A key feature of SushiSwap is its liquidity pools, where users can supply assets and earn transaction fees as well as SUSHI tokens as rewards. The platform’s SushiBar feature allows users to stake their SUSHI tokens, earning additional rewards and participating in the governance of the platform.

While SushiSwap provides a range of DeFi services, it may present a learning curve for those new to decentralized exchanges and AMM models. However, for those familiar with DEXs, it offers a variety of engaging and potentially lucrative opportunities.

Security is a crucial aspect of SushiSwap, with the platform focusing on the safety of user funds through smart contract audits and transparency in its operations. As a decentralized platform, it gives users control over their assets, reducing reliance on centralized authorities.

Customer support and community engagement are strong points for SushiSwap. The platform has an active community on various social media platforms and forums, where users can seek assistance and engage in discussions about the platform’s development and features.

| Type | Fee |

|---|---|

| Trading Fee | 0.30% |

9. Bisq - Best for Peer-to-Peer Trading Privacy

Trading Fees

0.15% - 1.15%

Supported Crypto

13+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR, NZD + 10 others Some through third party apps.

Bisq is selected for its unique position as a decentralized and open-source exchange, offering a peer-to-peer trading experience without the need for a central authority. Launched to provide a more private and secure way to trade cryptocurrencies, Bisq stands out for its emphasis on privacy and security, making it a top choice for users who prioritize these aspects in their trading activities.

Bisq’s decentralized nature means it operates on a global network of users, facilitating direct transactions between parties. This approach ensures that users retain complete control over their funds and personal data, distinguishing Bisq as a highly secure and private platform in the decentralized exchange landscape.

Bisq offers a decentralized trading platform that differs significantly from traditional centralized exchanges. As a peer-to-peer network, it allows users to buy and sell cryptocurrencies directly with each other, bypassing the need for a central intermediary.

The platform supports a wide range of cryptocurrencies and payment methods, providing flexibility and convenience for users. Bisq’s design is focused on maintaining user privacy and security, with no need for identity verification, thereby preserving the anonymity of its users.

One of the key features of Bisq is its security model, which is built on a decentralized arbitration system and security deposits to ensure fair and honest trading. This approach reduces the risk of fraud and enhances the overall trustworthiness of the platform.

Bisq’s user interface, while comprehensive, may present a steeper learning curve compared to more conventional exchanges. However, it offers detailed documentation and a supportive community to assist new users in navigating the platform.

Transaction fees on Bisq are low and are paid in the platform’s native token, BSQ, or in Bitcoin. These fees are used to fund the ongoing development of the platform and compensate contributors.

As a fully decentralized platform, Bisq does not offer traditional customer support services. Instead, support and guidance are provided through community forums and online resources, where users can seek help and share their experiences.

| Type | Fee |

|---|---|

| Trading Fee | 0.15% - 1.15% |

10. AirSwap - Best for Peer-to-Peer Token Trading

Trading Fees

0%

Supported Crypto

17+

Supported Fiat Currencies

No fiat currencies listed.

AirSwap is chosen for its innovative approach to decentralized token trading, emphasizing privacy and peer-to-peer transactions without intermediaries. Launched in 2017, AirSwap stands out in the decentralized exchange landscape for its use of Ethereum-based smart contracts and its unique token swap model, which facilitates direct, wallet-to-wallet trades with minimal slippage and no trading fees.

The platform’s commitment to a seamless and secure trading experience, without the need for order books or custodial risk, makes it an appealing option for users seeking a decentralized and user-friendly environment for trading Ethereum and ERC-20 tokens.

AirSwap offers a distinctive decentralized trading experience, focusing on peer-to-peer token swaps within the Ethereum ecosystem. The platform utilizes smart contract technology to enable direct trades from user to user, bypassing the need for centralized order books or intermediaries.

One of the key advantages of AirSwap is its privacy-centric approach. Users can trade tokens directly from their wallets without the need to disclose their identity or trading intentions publicly. This setup provides a high level of privacy and security, reducing the risk of front-running and other market manipulations.

The interface of AirSwap is designed to be intuitive and accessible, catering to both newcomers and experienced users in the decentralized trading space. The platform supports a wide range of ERC-20 tokens, offering users a diverse selection of trading pairs.

AirSwap operates without trading fees, which is a notable benefit for users. Instead, the platform relies on the spread determined in each peer-to-peer trade, ensuring transparent and fair pricing.

Security is a fundamental aspect of AirSwap, with the decentralized and non-custodial nature of the platform ensuring that users have full control over their funds at all times.

As a decentralized platform, AirSwap provides support primarily through online resources and community channels. Users can access guides, FAQs, and active community forums for assistance and to engage with other members of the AirSwap community.

| Type | Fee |

|---|---|

| Trading Fee | 0% |

How to Choose the Best Crypto Exchange

Selecting the right crypto exchange is a crucial decision for any trader, whether you’re a novice or a seasoned investor in the cryptocurrency market. The right platform can significantly impact your trading experience, security, and success. Here are key factors to consider when choosing the best crypto exchange:

- Security Measures: The paramount consideration is the security of your funds and personal information. Look for exchanges that employ robust security protocols such as two-factor authentication (2FA), cold storage for funds, encrypted personal data, and regular security audits. Decentralized exchanges often provide an added layer of security by allowing you to maintain control of your private keys.

- User Autonomy and Control: Evaluate how much control you have over your funds and transactions. Decentralized exchanges typically offer greater autonomy, eliminating the need for a central authority and reducing counterparty risks. This autonomy is crucial for those who prioritize a trustless environment.

- Ease of Use and Interface: The user interface should be intuitive and user-friendly, especially for those new to cryptocurrency trading. An overly complex interface can lead to errors and a frustrating trading experience. Consider platforms that strike a balance between advanced features and simplicity.

- Available Cryptocurrencies and Liquidity: The range of available cryptocurrencies is an important factor. More trading pairs and a diverse selection of coins provide more opportunities for trading. Additionally, high liquidity ensures easy entry and exit from positions, minimizing the risk of slippage.

- Advanced Trading Features: If you’re an experienced trader, advanced trading features can be crucial. These may include detailed charting tools and order types. However, ensure these features don’t compromise the platform’s security or user autonomy.

- Transaction Fees and Costs: Understand the fee structure of the exchange. Lower fees can significantly impact your profitability, especially if you are a high-frequency trader. Some decentralized exchanges offer lower fees compared to their centralized counterparts, but always weigh fees against other features and security.

- Regulatory Compliance and Stability: Ensure the exchange complies with regulatory requirements in your jurisdiction. A compliant platform minimizes the risk of future legal complications. Stability and a solid track record can also be indicators of a reliable exchange.

- Customer Support and Community: Good customer support can be invaluable, especially in resolving technical issues or during market anomalies. Decentralized exchanges often rely on community-driven support, which can also be a rich resource for learning and assistance.

- Anonymity and Privacy: If privacy is a concern, consider exchanges that do not require extensive personal information. Decentralized exchanges usually offer higher levels of anonymity than centralized platforms.

- Additional Features and Services: Some exchanges offer additional services like staking, yield farming, or liquidity pools. These can provide additional income streams and should align with your investment strategies and risk tolerance.

In summary, choosing the best crypto exchange involves balancing security, ease of use, features, fees, and regulatory compliance with your specific trading needs and goals. Always conduct thorough research and consider your individual requirements before committing to a platform. Remember, the ideal exchange for one trader might not be the best fit for another.

Final Thoughts

These platforms offer a level of autonomy, security, and user empowerment that is often unmatched in traditional financial systems. By putting control back in the hands of users and aligning with the core ethos of blockchain technology, DEXs represent a significant step forward in the democratization of finance.

The decentralized crypto exchanges we’ve reviewed offer a glimpse into the future of finance – one that is more inclusive, transparent, and user-centric. As you embark on or continue your journey in cryptocurrency trading, keep in mind the unique attributes and nuances of these platforms. Remember, the right choice of exchange is not just about the features it offers but also how well it aligns with your individual trading philosophy and goals.

FAQs

The most popular decentralized crypto exchange (DEX) is typically considered to be Uniswap, based on its high volume of trading and user base.

Uniswap operates on the Ethereum blockchain and allows users to swap various Ethereum-based tokens (ERC-20 tokens) directly from their wallets.

Most DEXs will have some form of transaction fee, primarily to compensate liquidity providers and cover network transaction costs (like gas fees on the Ethereum network). However, some newer DEXs may temporarily waive fees as a promotion.

It’s important to note that even if a DEX doesn’t have trading fees, users still have to pay blockchain network fees, which can be significant, especially on networks like Ethereum.

The downsides of using a decentralized exchange (DeX) include:

- Liquidity Issues: Some DEXs may have lower liquidity compared to centralized exchanges, which can lead to higher price slippage and less efficient trades.

- User Experience: DEXs can be less user-friendly, especially for those new to crypto trading.

- Limited Functionality: They often lack advanced trading features like margin trading, stop loss, etc.

- Smart Contract Risks: Being built on smart contracts, DEXs are susceptible to bugs or vulnerabilities in the contract code.

- Network Fees: Especially on networks like Ethereum, transaction (gas) fees can be high during peak times.

- No Fiat Support: Most DEXs do not support fiat currencies, so users must already own cryptocurrency to trade.

Methodology

Our team employs a rigorous rating process, analysing various criteria to determine our star rating system. This system allows us to condense our extensive research into an easy-to-understand format. For a deeper dive into our rating process, check out our full methodology.

We assess crypto exchanges based on the following criteria:

- Platform Usability: How user-friendly is the platform for beginners? What advanced tooling and charting features are available for seasoned traders?

- Supported Cryptocurrencies: What's the range of supported cryptocurrencies, and how frequently does the exchange add new ones?

- Supported Fiat Currencies: How many fiat currencies are supported? Are the banking relationships direct or through third parties?

- Deposit and Withdrawal Methods: Are there diverse methods for account funding and withdrawals?

- Fees: How competitive are the trading, deposits, and withdrawal fees? Is the exchange known for adding large spreads to conversions?

- Customer Support: How accessible and helpful is the customer support team? Are multiple support methods available?

- Exchange Activity: How proactive is the exchange in terms of updates? Is their social media presence active, and do they engage with the community regularly?

- Security: What security measures are in place to safeguard users, such as Two-Factor Authentication (2FA), relevant certifications and general security processes? If the exchange has experienced significant hacks, how have they addressed and evolved from those incidents?

- Regulatory Registrations: Does the exchange meet the necessary regulatory requirements to operate in Australia?