Featured In

Pros

Cons

Quick Summary

| Headquarters Location | New York, USA |

|---|---|

| Fiat Currencies Supported | USD, AUD, GBP, CAD, EUR + 2 others |

| Total Supported Cryptocurrencies | 147+ |

| Trading Fees | 0.05% - 0.15% |

| Deposit Methods | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Paypal, Apple Pay, Google Pay |

| Support | Facebook, Twitter, Instagram, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS, Android |

Welcome to our comprehensive review of Gemini, one of the premier cryptocurrency exchanges worldwide. Founded with a vision to provide secure and convenient means for purchasing, selling and storing digital assets worldwide, Gemini has grown into one of the go-to platforms among crypto enthusiasts across all corners of the globe.

Gemini has steadily cemented its place within the rapidly evolving cryptocurrency sector. As an exchange, Gemini stands out by not only offering a secure and user-friendly platform but also continually innovating – like a star model in a fashion show who charms with every appearance.

Gemini’s core design, tailored to accommodate users from diverse backgrounds and experience levels, remains at the core of its development strategy. As the crypto space advances, so too does Gemini – offering improvements that act like new links on an irreplaceable bracelet; each adding to its strength and aesthetic value.

About Gemini

Gemini Exchange has quickly made a name for itself since its debut, seeking to form a bridge to the future of money with a platform that blends traditional banking security with cutting-edge cryptocurrency innovations. Conceived by two notable figures in both technology and finance – the Winklevoss twins -, Gemini offers global users a diverse portfolio of digital asset offerings.

Gemini has navigated through the cryptocurrency market’s highs and lows with remarkable accuracy since its founding. Gemini’s journey has been marked by crucial historical events and market trends that served as catalysts for its own development and adaptation.

Gemini stands out in an industry defined by rapid changes by its aggressive and adaptive approach to scaling and expanding services. By adapting offerings accordingly – much like how an adjustable wristwatch caters to wearer comfort – Gemini has managed to maintain relevance in an otherwise challenging market environment.

Gemini has a number of active social profiles including Facebook, Twitter, Instagram, LinkedIn, Reddit, TikTok and YouTube.

Gemini has a mobile app on both the Apple App Store and Google Play.

Gemini Supported Cryptocurrencies

Gemini supports trading on over 147 cryptocurrencies on their platform. This exchange currently supports 18 of the top 30 market cap cryptocurrencies.

View all cryptocurrencies Gemini supports

- 1INCH

- AAVE

- ACH

- ADA

- ALCX

- ALI

- AMP

- ANKR

- APE

- API3

- ARB

- ASH

- ATOM

- AUDIO

- AVAX

- AXS

- BAL

- BAT

- BCH

- BICO

- BLUR

- BNT

- BOND

- BRD

- BTC

- CHZ

- COMP

- CRV

- CSP

- CTX

- CUBE

- CVC

- DAI

- DDX

- DOGE

- DOT

- DPI

- EFIL

- ELON

- ENJ

- ENS

- EOS

- ERN

- ETH

- EUL

- FET

- FIDA

- FIL

- FRAX

- FTM

- FXS

- GAL

- GALA

- GFI

- GHO

- GMT

- GNT

- GRT

- HNT

- ILV

- IMX

- INDEX

- INJ

- IOTX

- JUP

- KEEP

- KNC

- KP3R

- LDO

- LINK

- LOOM

- LPT

- LQTY

- LRC

- LTC

- LUNA

- MANA

- MASK

- MATIC

- MC

- MCO2

- METIS

- MIM

- MIR

- MKR

- MOON

- MPL

- NEAR

- NMR

- OCEAN

- OMG

- OP

- ORCA

- OXT

- PAXG

- PEPE

- PLA

- PUSH

- PYTH

- QNT

- QRDO

- RAD

- RARE

- RAY

- RBN

- REN

- REVV

- RFR

- RLY

- RNDR

- SAMO

- SAND

- SBR

- SEI

- SHIB

- SKL

- SLP

- SNX

- SOL

- SPELL

- STETH

- STG

- STORJ

- SUI

- SUSHI

- TAO

- TBTC

- TCAP

- TIA

- TOKE

- TRU

- UMA

- UNI

- USDC

- USDT

- WBTC

- WETH

- WIF

- WNXM

- WTON

- XLM

- XRP

- XTZ

- YFI

- ZBC

- ZEC

- ZRX

Trading Experience

Trading on Gemini is an enjoyable and effortless experience, thanks to an intuitive user interface and wide array of trading options. No matter your experience level or beginner status, Gemini provides all of the tools required for engaging with digital assets.

Advanced traders will appreciate the sophisticated features designed to facilitate a more professional trading approach.

Trading on Gemini can be likened to listening to high-quality headphones with 20Hz-20kHz frequency range, where every nuance of sound is captured exquisitely. Gemini provides an effective platform that provides traders with tools designed for all manner of trading activities.

Experience an engaging trading experience with all of the essential features you would find on an established exchange.

Gemini Fees

Understanding the fee structure of a crypto exchange is integral to its profitability, and Gemini has designed its fee model with this in mind, using a competitive yet transparent maker-taker fee schedule which reflects market liquidity without disclosing specific figures, making Gemini attractive for both casual and active traders alike.

Gemini provides an attractive fee structure designed to cater to both novice and seasoned traders alike. Just as DJs rely on an analog mixer option to fine-tune audio experiences, Gemini allows traders to navigate the market precisely while creating strategies within a flexible maker-taker fee schedule.

Fees must be carefully managed, much like tuning an audio system’s equalizer – to ensure they meet traders’ expectations for payment and services rendered.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | 0% |

| Deposit Fee (Credit/Debit Card) | 3.49% |

| Trading Fee | 0.05% - 0.15% |

| Withdrawal Fee (Bank Transfer) | 0% - $25 USD |

Gemini supports a range of different cryptocurrencies with varying withdrawal fees. When looking at Bitcoin, they don't charge anything above the standard Bitcoin network fee. Across all the crypto exchanges we've reviewed, the average Bitcoin transaction fee charged is 0.000461 BTC compared to the actual network fee of 0.000207 BTC. This means you are saving 55.18% on Bitcoin transactions by using Gemini instead of other exchanges.

Gemini has a maker/taker fee schedule which you can see below.

| 30-DAY TRADING VOLUME IN (USD NOTIONAL)¹ | TAKER FEE | MAKER FEE |

|---|---|---|

| 0 | 0.40% | 0.20% |

| ≥ $10,000 | 0.30% | 0.10% |

| ≥ $50,000 | 0.25% | 0.10% |

| ≥ $100,000 | 0.20% | 0.08% |

| ≥ $1,000,000 | 0.15% | 0.05% |

| ≥ $5,000,000 | 0.10% | 0.03% |

| ≥ $10,000,000 | 0.08% | 0.02% |

| ≥ $50,000,000 | 0.05% | 0.000% |

| ≥ $100,000,000 | 0.04% | 0.000% |

| ≥ $500,000,000 | 0.03% | 0.000% |

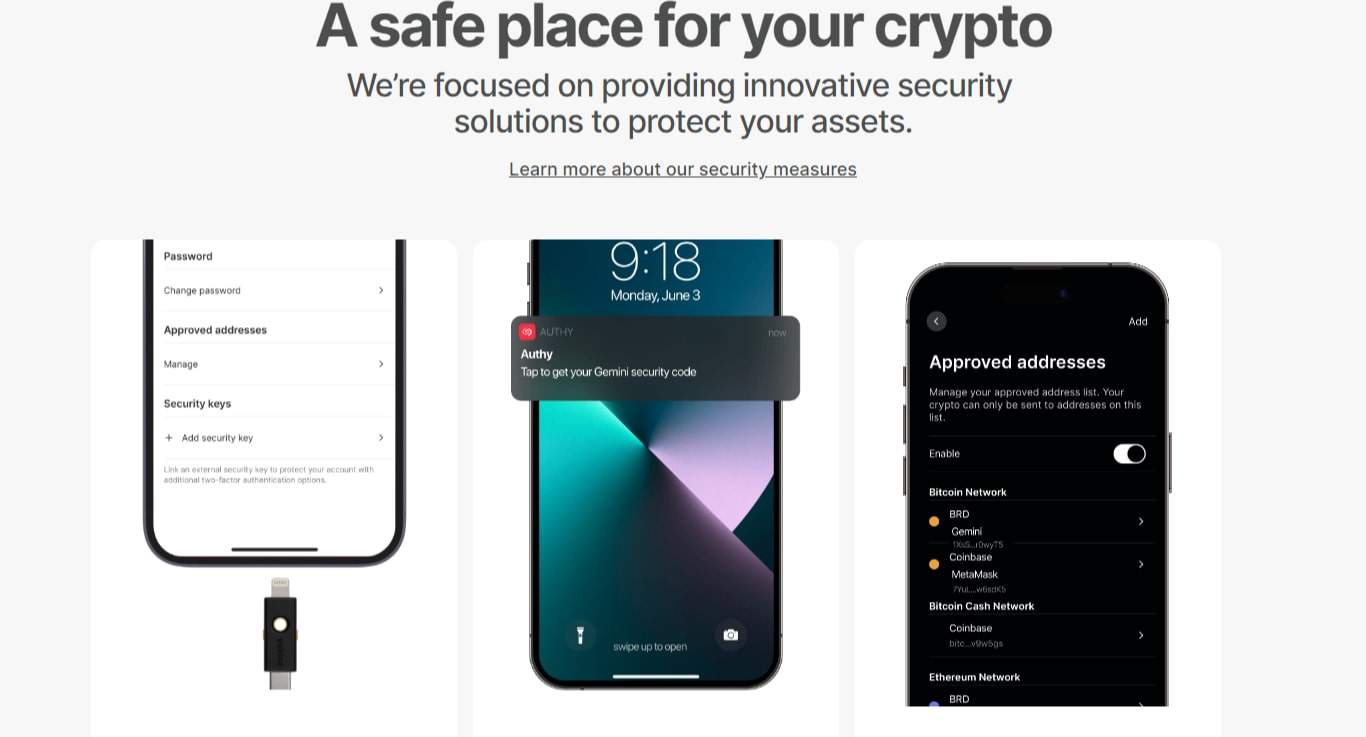

Security - Is Gemini Safe?

Gemini takes security and regulation very seriously, adhering to high standards of compliance while employing an approach centered around safety-first thinking. Their regulatory framework has been designed to safeguard users by adhering to an industry standard set of requirements.

Gemini is a licensed digital asset exchange and custodian built on top of industry-leading technology to protect funds and transactions.

Gemini security measures resemble those offered by an advanced model plate security system in that they incorporate protocols to safeguard transactions while also offering advanced features to further increase user safety – much like Hifi Headphone designs, which incorporate multiple layers of sound insulation for user protection.

From two-factor authentication to wallet address whitelisting, an exchange employs stringent security checks that mirror those taken by timepiece enthusiasts when operating their chronographs.

Gemini Customer Support

Customer support is an integral aspect of any service, and Gemini excels at it. Offering multiple channels for support, users can depend on timely assistance for any problems they encounter.

Customer support team is knowledgeable and eager to assist users looking for guidance.

Gemini’s customer support system stands as a testament to their dedication to user satisfaction. Imagine having access to quality service whenever needed from any device with an easily accessible headphone port!

Gemini offers users access to multiple channels for assistance and an accommodating support team who are eager to offer assistance – much like an adjustable strap on the Beco Gemini baby carrier that can be adjusted to provide optimal comfort in accommodating toddlers aged 1-2 months old.

Gemini Support Channels

How to Sign Up on Gemini

- Create Account - Visit the Gemini website and fill out the create account form. You'll need to include a valid email, set your password and type in other details like your phone number and name.

- Verify Account - Confirm your email, you should get an email asking you to verify your account creation.

- Transferring Funds - Once your account has been verified, you'll be able to deposit using the deposit methods listed below.

- Start Trading Crypto - That's it! You should now have everything in place to start trading.

Deposit Methods

Gemini Alternatives

Binance

Total Supported Cryptocurrencies

386+

Trading Fees

0.10%

Fiat Currencies Supported

USD, GBP, CAD, EUR, NZD + 75 others

Kraken

Total Supported Cryptocurrencies

244+

Trading Fees

0.08% - 0.40%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR + 1 other

OKX

Total Supported Cryptocurrencies

320+

Trading Fees

0.08% - 0.10%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 85 others

Final Thoughts

After careful evaluation, Gemini stands out as an innovative platform that provides an impressive variety of services. Thanks to its user-centric design philosophy, this exchange continues to adapt by adding features and making improvements that enhance trading experiences overall.

Gemini FAQs

Gemini is generally considered a trusted cryptocurrency exchange, known for its adherence to compliance and security measures. It is a licensed digital asset exchange and custodian built by the Winklevoss twins and is regulated by the New York State Department of Financial Services (NYSDFS).

The platform prioritizes user safety and employs security protocols such as two-factor authentication and wallet address whitelisting.

To withdraw money from Gemini, you need to log in to your account, navigate to the withdrawal section, select the currency you wish to withdraw, and choose a withdrawal method, such as bank transfer or to another wallet address. Follow the prompts to complete the withdrawal process, ensuring that you have met any withdrawal requirements and verified the necessary details.

Gemini has a feature called Gemini Earn that allows users to earn interest on their cryptocurrency holdings. The ability to withdraw from Gemini Earn depends on the terms of service and the conditions under which you agreed to participate in the program.

Withdrawals from Gemini Earn typically involve transferring your funds back to your trading account balance, which can then be withdrawn according to Gemini’s standard withdrawal process.

Withdrawal times from Gemini can vary depending on the method you use and the currency. For fiat currency withdrawals to a bank account, it usually takes 1-5 business days.

Cryptocurrency withdrawals can typically be processed more quickly, often within a few minutes to an hour, although network congestion can impact transaction times.

Both Gemini and Crypto.com are reputable exchanges that prioritize security, but their safety features may differ. Gemini is known for its strong regulatory compliance and security measures, while Crypto.com also offers robust security features.

Users should review the specific security protocols, insurance policies, and regulatory statuses of each platform to determine their comfort level with the exchange’s safety.

Gemini is often recognized for its user-friendly interface, strong regulatory compliance, and security features. The platform offers a variety of tools for both beginner and experienced traders, including a mobile app, and is known for its clear and transparent fee structure.

Additionally, Gemini provides customer support and educational resources to help users navigate the crypto market.

Gemini and Coinbase are both well-regarded in the industry for their security measures. They offer similar security features like two-factor authentication and insured hot wallets.

Each platform’s adherence to regulatory standards and commitment to security is designed to protect users’ assets. Users should investigate both exchanges’ latest security practices and insurance coverages to make an informed decision.

If you’re interested in seeing how Gemini stacks up against other crypto exchanges (aside from Coinbase), view our article comparing Kraken vs Gemini.

Yes, Gemini trading is legitimate. It operates as a licensed digital asset exchange and custodian, regulated by the New York State Department of Financial Services.

The platform is also SOC 1 Type 2 and SOC 2 Type 2 compliant, further affirming its commitment to high security and operational standards.

Gemini User Reviews

0.0 out of 5.0

0 reviews

No reviews yet for Gemini - be the first to review!

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.

Best Cryptocurrency Exchange for Beginners

Best Cryptocurrency Exchange for Beginners