Featured In

Pros

Cons

Quick Summary

| Headquarters Location | International |

|---|---|

| Fiat Currencies Supported | USD, AUD, GBP, CAD, EUR + 1 other |

| Total Supported Cryptocurrencies | 244+ |

| Trading Fees | 0.08% - 0.40% |

| Deposit Methods | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Paypal, Apple Pay, Google Pay, PayID, Osko |

| Support | Facebook, Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS, Android |

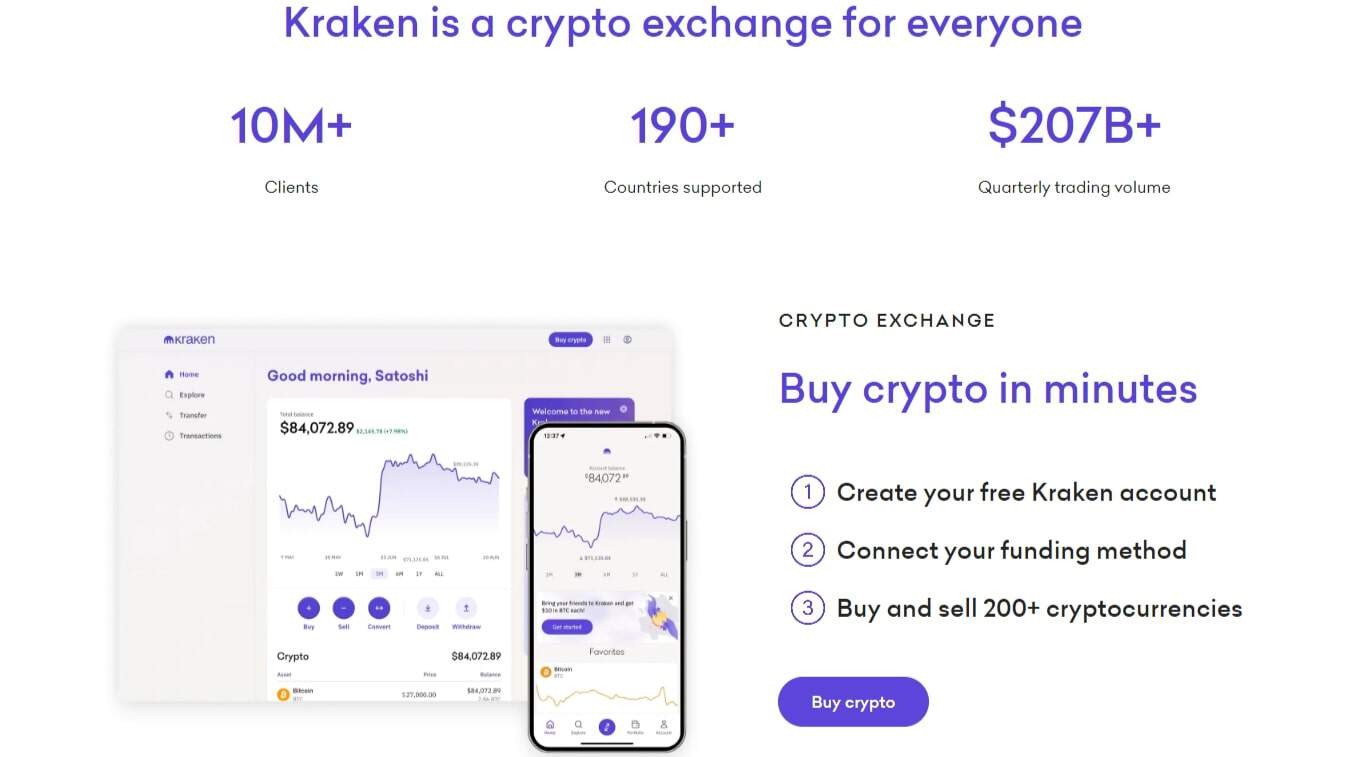

Dive into the world of cryptocurrency with the Kraken exchange, a platform renowned for its depth and comprehensive capabilities, much like the vastness of the ocean it metaphorically represents.

Kraken extends its services globally, presenting a wealth of crypto trading options for both experienced investors and newcomers. It serves as a guiding light for traders navigating the often unpredictable currents of digital finance.

Kraken equips traders with the tools and insights needed to traverse the cryptocurrency market confidently. It offers an extensive range of trading opportunities for individuals at every level of experience, demonstrating its adaptability and growth in response to the evolving digital finance environment.

About Kraken

Founded in the complex landscape of the financial world, Kraken was established in 2011 as a pioneering platform for those venturing into the emerging cryptocurrency market. It has been committed to enhancing security and promoting the widespread adoption of digital currencies, navigating through the evolving terrain of digital assets.

As a leader in the industry, Kraken has successfully navigated numerous challenges, securing its position as a primary destination for crypto traders worldwide.

From its early days, Kraken has experienced and adapted to significant market shifts and regulatory developments, showcasing its resilience and flexibility. Its journey is characterized by continual innovation and a steadfast commitment, mirroring the growth of the cryptocurrency sector.

With the expansion of the digital asset ecosystem, Kraken has broadened its offerings, incorporating new cryptocurrencies and features to accommodate the increasing demands of its clientele. The exchange’s development is underscored by strategic alliances and growth initiatives, emphasizing its significance in the global financial narrative.

Kraken has a number of active social profiles including Facebook, Twitter, Instagram, LinkedIn, Reddit, Telegram, TikTok and YouTube.

Kraken has a mobile app on both the Apple App Store and Google Play.

Kraken Supported Cryptocurrencies

Kraken supports trading on over 244 cryptocurrencies on their platform. This exchange currently supports 23 of the top 30 market cap cryptocurrencies.

View all cryptocurrencies Kraken supports

- 1INCH

- AAVE

- ACA

- ACH

- ADA

- ADX

- AGLD

- AIR

- AKT

- ALCX

- ALGO

- ALICE

- ALPHA

- ANKR

- ANT

- APE

- API3

- APT

- ARB

- ARPA

- ASTR

- ATLAS

- ATOM

- AUDIO

- AVAX

- AVT

- AXS

- BADGER

- BAL

- BAND

- BAT

- BCH

- BICO

- BIT

- BLUR

- BLZ

- BNC

- BNT

- BOBA

- BOND

- BONK

- BRICK

- BSX

- BTC

- BTT

- C98

- CELR

- CFG

- CHR

- CHZ

- COMP

- COTI

- CQT

- CRV

- CSM

- CTSI

- CVC

- CVX

- DAI

- DASH

- DENT

- DOGE

- DOT

- DYDX

- DYM

- EGLD

- ENJ

- ENS

- EOS

- ETC

- ETH

- ETHW

- EUL

- EURT

- EWT

- FARM

- FET

- FIDA

- FIL

- FIS

- FLOW

- FLR

- FORTH

- FTM

- FXS

- GAL

- GALA

- GARI

- GENS

- GHST

- GLMR

- GMT

- GMX

- GNO

- GRT

- GST

- GTC

- HDX

- HFT

- HNT

- ICP

- ICX

- IDEX

- IMX

- INJ

- INTR

- JASMY

- JTO

- JUNO

- JUP

- KAR

- KAVA

- KEEP

- KEY

- KILT

- KIN

- KINT

- KNC

- KP3R

- KSM

- LCX

- LDO

- LINK

- LMWR

- LPT

- LRC

- LSK

- LTC

- LUNA

- LUNA2

- MANA

- MASK

- MATIC

- MC

- MINA

- MIR

- MKR

- MLN

- MNGO

- MOON

- MOVR

- MSOL

- MULTI

- MV

- MXC

- NANO

- NEAR

- NMR

- NODL

- NYM

- OCEAN

- OGN

- OMG

- OP

- ORCA

- OTP

- OXT

- OXY

- PAXG

- PEPE

- PERP

- PHA

- PICA

- PLA

- POL

- POLIS

- POLS

- POND

- POWR

- PSTAKE

- PYTH

- PYUSD

- QNT

- QTUM

- RAD

- RARE

- RARI

- RAY

- RBC

- REN

- REP

- REPV2

- REQ

- RLC

- RNDR

- ROOK

- RPL

- RUNE

- SAMO

- SAND

- SBR

- SC

- SCRT

- SDN

- SEI

- SGB

- SHIB

- SNX

- SOL

- SPELL

- SRM

- STEP

- STG

- STORJ

- STRK

- STX

- SUI

- SUPER

- SUSHI

- SXP

- SYN

- T

- TBTC

- TEER

- TIA

- TLM

- TOKE

- TRU

- TRX

- TUSD

- TVK

- UMA

- UNFI

- UNI

- USDC

- USDT

- UST

- W

- WAVES

- WAXL

- WBTC

- WETH

- WIF

- WOO

- XCN

- XLM

- XMR

- XRP

- XRT

- XTZ

- YFI

- YGG

- ZEC

- ZRX

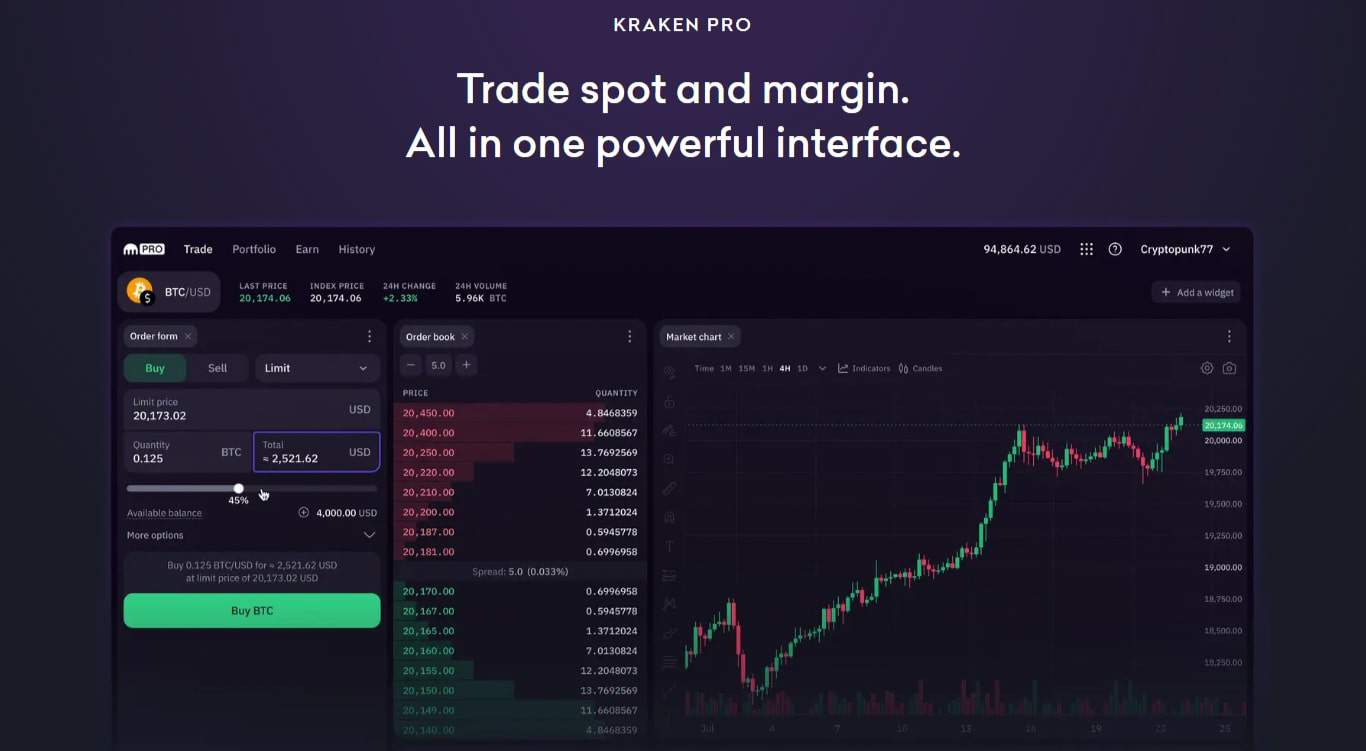

Trading Experience

Kraken’s platform is developed to serve a wide range of users, from those new to investing to seasoned traders. It offers a comprehensive trading environment, featuring everything from simple buy and sell options for beginners to intricate charting tools for the more experienced.

The platform provides traders with a diverse set of tools, enabling them to tailor their trading approach to their specific needs and preferences. Whether users are looking for straightforward trades or wish to explore more complex strategies, Kraken supports a variety of trading activities.

Kraken prioritizes accessibility and versatility, ensuring users have the tools and support they need to navigate the trading landscape effectively. This commitment to user empowerment makes Kraken a supportive platform for all traders, helping them to engage with the cryptocurrency market confidently.

Kraken Fees

Kraken’s fee system is a tiered model, designed to reward users for higher trading volumes by offering lower transaction fees. This approach incentivizes increased trading activity, directly linking the costs to the user’s level of engagement on the platform.

As traders become more active, they benefit from progressively reduced fees, creating a mutually beneficial environment that encourages liquidity and active participation in the market.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | $0 USD - $5 USD |

| Deposit Fee (Credit/Debit Card) | Not Listed |

| Trading Fee | 0.08% - 0.40% |

| Withdrawal Fee (Bank Transfer) | $0 USD - $35 USD |

Kraken supports a range of different cryptocurrencies with varying withdrawal fees. When looking at Bitcoin, they don't charge anything above the standard Bitcoin network fee. Across all the crypto exchanges we've reviewed, the average Bitcoin transaction fee charged is 0.000594 BTC compared to the actual network fee of 0.000473 BTC. This means you are saving 20.34% on Bitcoin transactions by using Kraken instead of other exchanges.

Kraken has a maker/taker fee schedule which you can see below.

| 30- Day Volume (USD) | Maker | Taker |

|---|---|---|

| $0 – $10,000 | 0.25% | 0.40% |

| $10,001 – $50,000 | 0.20% | 0.35% |

| $50,001 – $100,000 | 0.14% | 0.24% |

| $100,001 – $250,000 | 0.12% | 0.22% |

| $250,001 – $500,000 | 0.10% | 0.20% |

| $500,001 – $1,000,000 | 0.08% | 0.18% |

| $1,000,001 – $2,500,000 | 0.06% | 0.16% |

| $2,500,001 – $5,000,000 | 0.04% | 0.14% |

| $5,000,001 – $10,000,000 | 0.02% | 0.12% |

| $10,000,000+ | 0.00% | 0.10% |

Security - Is Kraken Safe?

Navigating the complexities of the digital asset market demands a platform with exceptional security measures, and Kraken meets this need with its comprehensive safety protocols. Operating within a stringent regulatory framework, Kraken ensures adherence to all necessary compliance measures to protect its users’ assets.

Kraken’s security infrastructure is meticulously designed to guard against the diverse threats present in the cryptocurrency environment. The exchange utilizes advanced technology and a multi-layered defense approach to safeguard user funds.

Incorporating two-factor authentication, state-of-the-art encryption, and continuous monitoring systems, Kraken’s security measures serve as a robust defense against potential digital threats. This steadfast dedication to security offers traders peace of mind, knowing their assets are well-protected with Kraken’s vigilant oversight.

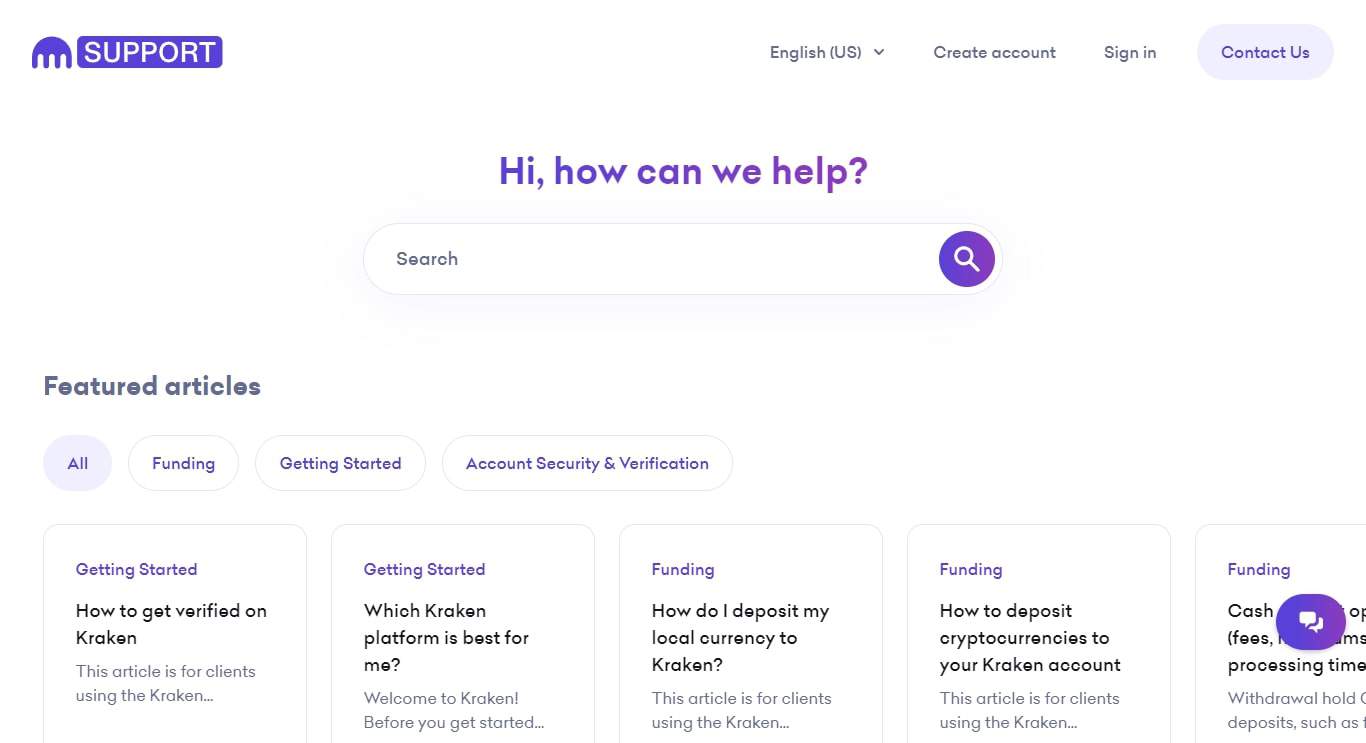

Kraken Customer Support

In the event of any challenges or inquiries, Kraken’s customer support team is fully prepared to assist. Acting as a constant vigil, they monitor for any issues that traders might encounter.

Kraken offers a range of support channels, from direct helplines to detailed FAQs and support articles, ensuring that every user receives the assistance they need.

The customer support at Kraken serves as a guiding force, ready to navigate traders through any uncertainties or questions they might have. With a focus on timely and effective assistance, the team is dedicated to addressing a variety of concerns, making sure that no user feels left behind.

This dedication to superior customer service is fundamental to Kraken’s approach, building a strong sense of trust and commitment within its community of users.

Kraken Support Channels

How to Sign Up on Kraken

- Create Account - Visit the Kraken website and fill out the create account form. You'll need to include a valid email, set your password and type in other details like your phone number and name.

- Verify Account - Confirm your email, you should get an email asking you to verify your account creation.

- Transferring Funds - Once your account has been verified, you'll be able to deposit using the deposit methods listed below.

- Start Trading Crypto - That's it! You should now have everything in place to start trading.

Deposit Methods

Kraken Alternatives

Binance

Total Supported Cryptocurrencies

386+

Trading Fees

0.10%

Fiat Currencies Supported

USD, GBP, CAD, EUR, NZD + 75 others

OKX

Total Supported Cryptocurrencies

320+

Trading Fees

0.08% - 0.10%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 85 others

Bybit

Total Supported Cryptocurrencies

462+

Trading Fees

0.0675% - 0.1200%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 160 others

Final Thoughts

Within the competitive landscape of cryptocurrency exchanges, Kraken distinguishes itself through a comprehensive suite of trading features and a robust reputation for security. Its dedication to creating a safe environment for traders positions it as a premier choice for those engaging in the digital currency market.

In the dynamic domain of digital finance, platforms such as Kraken are crucial. They function not only as venues for buying and selling but also as incubators for innovation, driving the evolution of trading and investment strategies.

As the cryptocurrency sector progresses, exchanges play a central role in guiding the integration of digital assets into the broader financial ecosystem, shaping a future where these currencies become a staple in financial transactions and investment portfolios.

Kraken FAQs

Kraken is recognized as one of the well-established and legitimate cryptocurrency exchanges, operating since 2011. It has built a reputation for its broad range of supported cryptocurrencies and services, including offering a platform for trading various digital assets.

If you’re wondering how Kraken fares against competitors in the crypto world, our articles provide detailed comparisons for Coinbase vs Kraken, Gatehub vs Kraken, Kraken vs Bitstamp, Kraken vs Gemini, and Poloniex vs Kraken.

As with any trading platform, there is always the risk of financial loss when using Kraken. Market volatility, trading decisions, and security risks can all contribute to the potential for losing money.

Kraken employs a variety of security measures to protect user funds, such as two-factor authentication and encrypted email communications. Nonetheless, no platform can guarantee absolute safety, and it’s important for users to use strong personal security practices.

There are no current reports suggesting that Kraken is in trouble. It is advisable to stay updated on the latest news and perform due diligence when considering the use of any financial platform.

Kraken is not an Australian exchange; it is a US-based cryptocurrency exchange. However, it offers services to many countries around the world, including Australia.

Kraken operates legally in the jurisdictions where it is allowed to offer its services. It complies with various regulatory requirements necessary to operate in each region.

Yes, Kraken operates in Australia and provides Australian users with access to its cryptocurrency trading platform.

Kraken, like many other financial institutions, may comply with local tax laws and could be required to report to authorities such as the Australian Taxation Office (ATO) to ensure compliance with Australian tax regulations. Users should consult a tax professional for their personal tax obligations.

Kraken User Reviews

0.0 out of 5.0

0 reviews

No reviews yet for Kraken - be the first to review!

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.

Best Cryptocurrency Exchange for Beginners

Best Cryptocurrency Exchange for Beginners Best International Cryptocurrency Exchange

Best International Cryptocurrency Exchange