Pros

Cons

Quick Summary

| Headquarters Location | Majuro, Marshall Islands |

|---|---|

| Fiat Currencies Supported (through third party apps) | USD, AUD, CAD, EUR + 14 others |

| Total Supported Cryptocurrencies | 1000+ |

| Trading Fees | Not Listed |

| Deposit Methods | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Apple Pay, Google Pay, Mercuryo |

| Support | Facebook, Twitter, Live Chat, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS, Android |

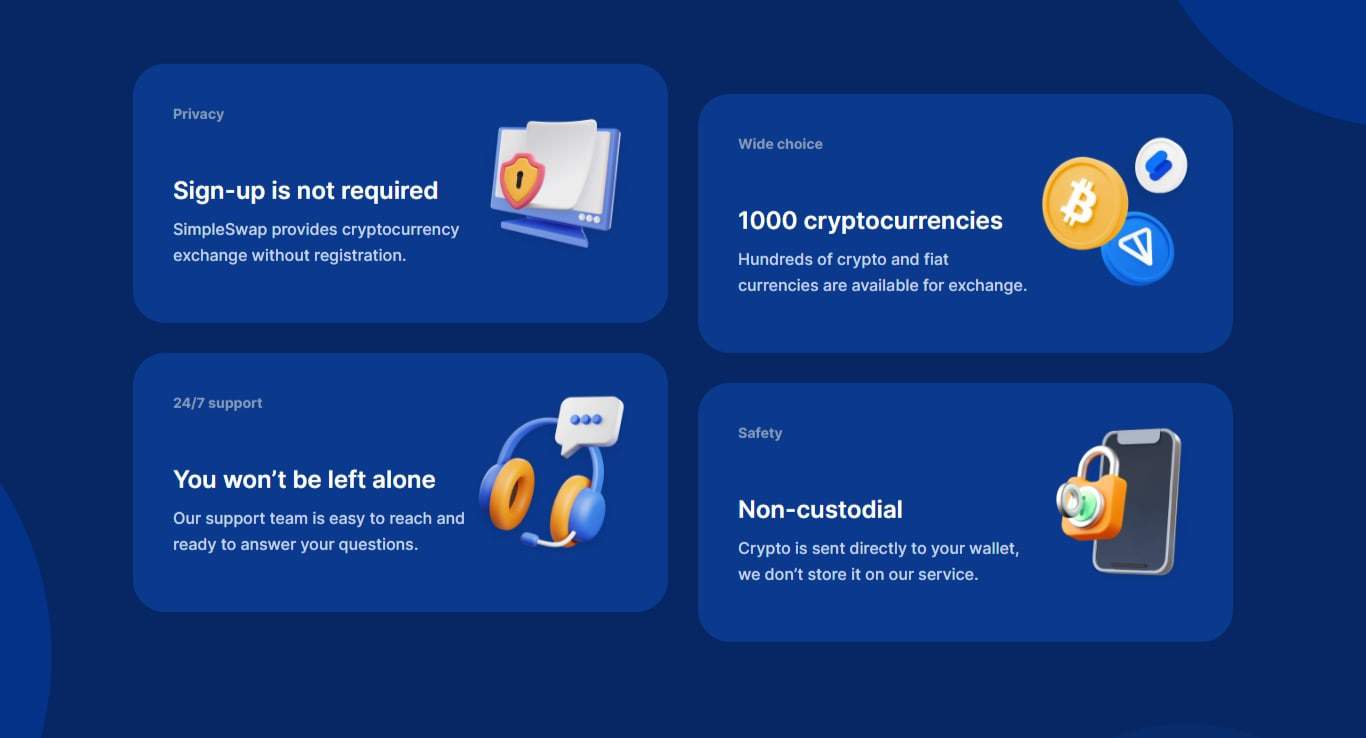

SimpleSwap is an instant cryptocurrency exchange offering an effortless and seamless method to swap various digital assets. The platform stands out for its ease of use, making it accessible for beginners as well as experienced traders searching for fast and painless cryptocurrency trades.

As our digital world rapidly changes, the importance of an efficient and trustworthy cryptocurrency exchange becomes ever more crucial. SimpleSwap has long been recognized for being accessible in this arena – adding yet another feather to their cap as one of the pioneering services within it.

With its no-frills approach and simple design, this platform has gained widespread acclaim among users who prioritize efficiency and simplicity. Its mission is to demystify cryptocurrency trading process as quickly and seamlessly as possible from discovery to transaction.

About SimpleSwap

SimpleSwap has quickly made waves in the cryptocurrency exchange market since its debut. Offering users an intuitive platform for easy crypto swaps, without all the complexities that go along with traditional exchanges, SimpleSwap stands out by offering direct trading directly from wallets.

Over time, they have expanded their services to accommodate a diverse customer base by offering various currencies.

SimpleSwap has been shaped not only by user demand but also by wider financial market undercurrents. As digital currencies have gained mainstream awareness, SimpleSwap has proven adept at adapting to these tides.

SimpleSwap has seen tremendous success as it evolved in tandem with key milestones in the crypto space, such as Bitcoin halving events and Ethereum smart contracts becoming popular. Each event in the industry had an effectful ripple-through to their services and outreach strategies at SimpleSwap.

SimpleSwap has a number of active social profiles including Facebook, Twitter, Instagram, Reddit, Telegram, TikTok and YouTube.

SimpleSwap has a mobile app on both the Apple App Store and Google Play.

Trading Experience

SimpleSwap was built with user experience in mind, offering an intuitive trading journey from selecting trading pairs to transaction completion. No matter where your journey leads you – SimpleSwap makes trading seamless!

SimpleSwap understands the experience of using an exchange is of utmost importance for traders, so we have tailored its trading experience accordingly, providing something suitable for those just getting started or those seeking more efficient routes into crypto trading.

The platform provides a trading environment that encourages quick and decisive action, giving traders confidence to navigate market volatility while making more-informed trading decisions.

SimpleSwap Fees

SimpleSwap makes its fee structure accessible; users are made aware of all costs associated with their transactions on this platform, without being blindsided by hidden surprises. While specific numbers will not be discussed here, fees have been set competitively with an aim of providing value to participants engaging in crypto swaps.

SimpleSwap’s emphasis has been to achieve an equilibrium between value and sustainability when setting its fees structure.

Fees on our platform have been structured to be fair, providing an attractive option for both occasional users and traders who engage in frequent trading. Transparency of costs serves to maintain trust while giving users the chance to fully explore all available services before engaging.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | 4.95% |

| Deposit Fee (Credit/Debit Card) | 4.95% |

| Trading Fee | Not Listed |

| Withdrawal Fee (Bank Transfer) | Not Listed |

Security - Is SimpleSwap Safe?

SimpleSwap takes great care in protecting its user transactions by adhering to industry-standard security practices and adhering to regulatory compliance practices, offering users peace of mind for the safekeeping of their digital assets.

Security is at the core of any exchange’s reputation and reliability. At SimpleSwap, our commitment to safeguarding user transactions goes far beyond basic measures – with robust protocols and a vigilant eye kept out for potential threats being implemented as safeguards.

Focusing on security also extends to meeting regulatory requirements, helping build trust between users and creating an ideal platform for digital asset trading. SimpleSwap stands as an exemplar of such security in practice.

SimpleSwap Customer Support

SimpleSwap understands customer support to be of utmost importance for its service, which is why its platform features a robust support system with real-time chat capability to address user inquiries and complaints promptly, reflecting its dedication to providing exceptional service and ensuring complete customer satisfaction.

Customer support is a cornerstone of user satisfaction, and SimpleSwap understands its place within its service offering. By offering responsive chat functionality and remaining visible across platforms such as Twitter and Telegram, SimpleSwap ensures users have multiple ways of seeking assistance or resolving transactions disputes quickly, thus providing comprehensive care for its clients.

SimpleSwap Support Channels

How to Sign Up on SimpleSwap

- Create Account - Visit the SimpleSwap website and fill out the create account form. You'll need to include a valid email, set your password and type in other details like your phone number and name.

- Verify Account - Confirm your email, you should get an email asking you to verify your account creation.

- Transferring Funds - Once your account has been verified, you can deposit using the methods listed below. Note that this exchange only supports depositing fiat currencies through third party apps it supports.

- Start Trading Crypto - That's it! You should now have everything in place to start trading.

Deposit Methods

SimpleSwap Alternatives

Binance

Total Supported Cryptocurrencies

386+

Trading Fees

0.10%

Fiat Currencies Supported

USD, GBP, CAD, EUR, NZD + 75 others

Kraken

Total Supported Cryptocurrencies

244+

Trading Fees

0.08% - 0.40%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR + 1 other

OKX

Total Supported Cryptocurrencies

320+

Trading Fees

0.08% - 0.10%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 85 others

Final Thoughts

SimpleSwap stands out as an efficient and user-friendly cryptocurrency swapping service, simplifying exchange processes while meeting market needs.

As the digital finance landscape continues to develop, new technologies and trends emerge, crypto exchanges like SimpleSwap play a vital role in shaping user experiences and the wider market structure. Developments in blockchain technology, increasing institutional adoption of cryptocurrency usage, as well as regulatory developments will have an effectful ripple-through of influence for exchanges such as SimpleSwap.

These platforms serve more than merely as facilitators – they play an active role in driving digital finance innovation.

SimpleSwap FAQs

SimpleSwap is an instant cryptocurrency exchange that allows users to swap a wide range of cryptocurrencies without the need to register an account. Trust in any platform is subjective and varies per user, but SimpleSwap has built a trustworthy reputation among many in the crypto community.

It offers a non-custodial service, meaning that there is no deposit storage; users retain control of their funds during the exchange process. SimpleSwap provides a platform for users to exchange assets at market rates, and it focuses on maintaining security measures to protect transactions.

For potential users, it’s always advisable to conduct personal research, read user reviews, and consider market conditions.

SimpleSwap offers a service that allows for a degree of anonymity as it doesn’t require users to create an account or undergo KYC (Know Your Customer) procedures for most of its swap services. Users simply provide a deposit address for the currency they want to swap and a recipient address for the converted assets.

This process can typically be done without providing personal information, making it an attractive option for users seeking privacy. However, for certain transactions or when using specific features, such as buying crypto with fiat currencies, SimpleSwap may require additional information in compliance with regulatory requirements.

SimpleSwap charges a fee for facilitating crypto swaps, but it doesn’t have a fixed fee structure. Instead, exchange fees are included in the exchange rate provided at the time of the transaction.

These rates can fluctuate due to market volatility and network fees, which are inherent in the blockchain network used for the transaction. The platform aims to offer competitive exchange rates by aggregating prices from partner exchanges.

It’s important for users to check the final rate provided before completing a swap to understand the total cost.

SimpleSwap competes with a variety of other crypto exchange services. Its competitors include other instant exchange platforms, centralized exchanges, and decentralized exchanges that offer similar services.

Some of these competitors might offer a broader range of trading pairs, advanced trading options, or additional features such as liquidity pools, affiliate programs, and loyalty rewards. Competitors may also differ in fee structures, security measures, and the ability to handle fiat transactions.

Users often compare different platforms based on these criteria to find the one that best suits their trading needs and preferences.

SimpleSwap does not publicly list a specific physical location or headquarters, which is common for many decentralized and non-custodial crypto exchange services. The platform operates primarily online, offering its services globally to an international customer base.

Users can interact with SimpleSwap through its website or mobile applications and can seek customer service through various channels like chat support, email, and social media platforms such as Twitter and Telegram.

SimpleSwap is an instant exchange platform that facilitates crypto swaps in a few simple steps, without the need for account creation or KYC procedures. Users select the exchange pair from a drop-down list on the platform, provide a deposit address for the digital asset they wish to swap, and the recipient wallet address for the converted currency.

After initiating the swap, SimpleSwap provides users with a deposit address where they send the cryptocurrency they wish to exchange. The platform then processes the transaction, often within minutes, and sends the swapped cryptocurrency to the provided recipient address.

The simplicity of the swap process, alongside a variety of trading pairs and the absence of maximum limits for transactions, makes SimpleSwap accessible to both new and experienced crypto enthusiasts.

The rating of SimpleSwap can vary across different review platforms and user-generated feedback. Users typically rate an exchange based on factors like user experience, reliability, response time, security, and customer service.

SimpleSwap generally receives positive feedback for its user-friendly interface, straightforward swap process, and customer support. However, as with any service, there are mixed reviews, and experiences can vary.

It’s advisable for potential users to read through various SimpleSwap reviews, including those on independent review sites and forums, to gauge the general sentiment and decide if it aligns with their own criteria for a crypto exchange service.

SimpleSwap operates as an online cryptocurrency exchange service and does not publicly disclose a physical headquarters location. The platform is accessible globally and is designed to cater to a wide international user base, providing services over the internet and accessible via its website and mobile application.

The decentralized nature of the service means that users from many different regions can utilize SimpleSwap without the need for a centralized location. For specific customer service inquiries or corporate-related questions, users can reach out via the platform’s support channels, such as chat or social media.

SimpleSwap User Reviews

1.0 out of 5.0

1 reviews

Showing 1 of 1 Review

Harry (United Kingdom) 2 months ago

worst exchange ever

Waiting for more than 2 hours for a simple XMR to BTC exchange. You loose money because the rate changes so fast. They come up with all kind of excuses and they do nothing. This is not an instant exchange, as they claim. STAY AWAY

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.