Pros

Cons

Quick Summary

| Headquarters Location | Brooklyn, New York, USA |

|---|---|

| Fiat Currencies Supported (through third party apps) | USD, AUD, GBP, CAD, EUR, NZD + 33 others |

| Total Supported Cryptocurrencies | 1093+ |

| Trading Fees | 0.30% |

| Deposit Methods | Cryptocurrency, MoonPay |

| Support | Twitter, Instagram, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS |

Uniswap has quickly become a household name in decentralized finance. It provides an innovative cryptocurrency exchange service. Leveraging Ethereum’s blockchain, this trailblazer empowers users with seamless trading of ERC-20 tokens.

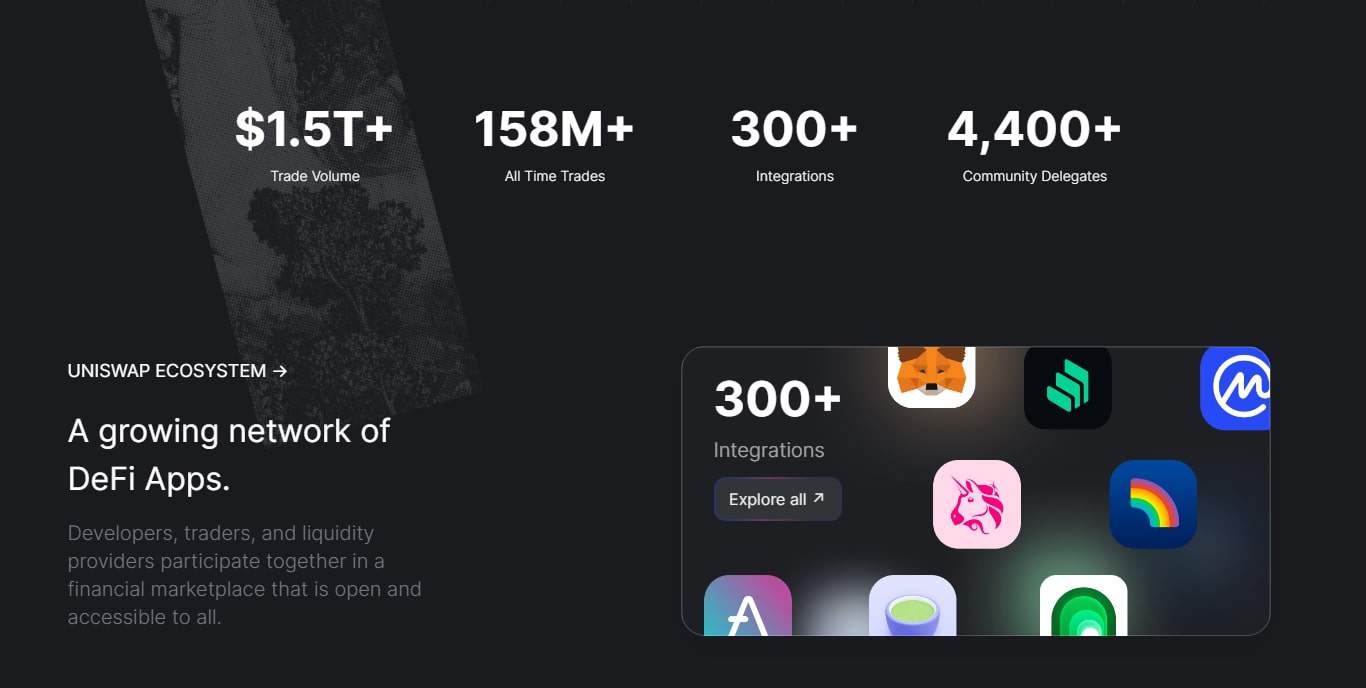

Uniswap has quickly established itself within the decentralized finance ecosystem, distinguishing itself with an innovative protocol that removes third-party intermediaries. It has grown alongside Ethereum adoption and now impacts how liquidity is perceived and utilized across its network.

Uniswap has quickly become one of the go-to platforms for decentralized trading of digital assets, offering innovative deployment of liquidity on Ethereum’s framework and opening doors for both experienced crypto traders and newcomers looking for their first steps into digital asset trading.

About Uniswap

Uniswap was born from a mechanical engineer’s vision for a decentralized exchange protocol on the Ethereum network. Since its conception, Uniswap Labs has led its development, producing V1, V2 and, more recently, V3, each iteration improving capital efficiency and liquidity provision.

Uniswap’s funding rounds, featuring significant investments from Andreessen Horowitz, have propelled it into the forefront of DeFi innovation.

Uniswap has long been at the centre of pivotal moments in the blockchain sector. Its launch period coincided with an increasing interest in Ethereum-based tokens, at a momentous turning point when cryptocurrency markets were ready for a decentralised exchange that upheld the principles of the Ethereum Foundation.

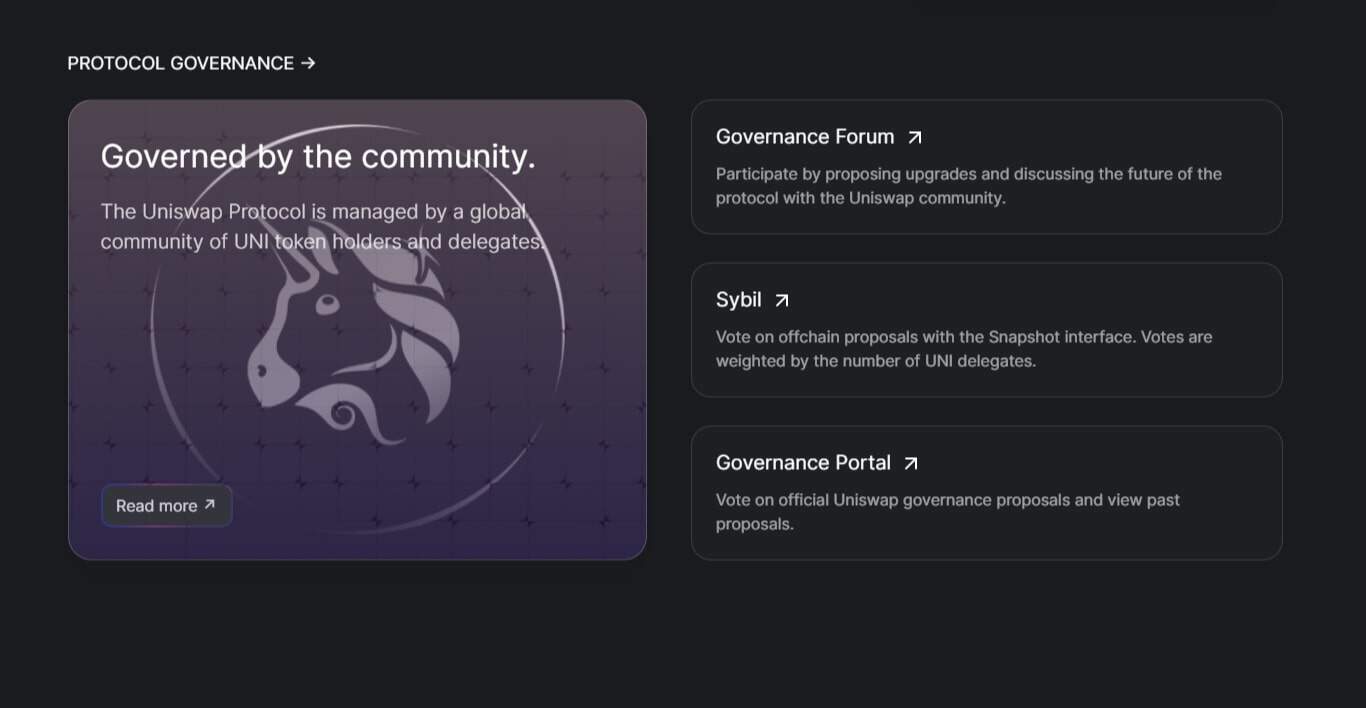

Uniswap’s native governance token, UNI, quickly became an instrumental component in strengthening its presence within markets. Their release of version 3, featuring Concentrated Liquidity and enhanced Capital Efficiency, responded to evolving needs within crypto trading communities and further solidified their position within an exchange environment that provides alternative services and liquidity sources.

Uniswap has a number of active social profiles including Twitter, Instagram, LinkedIn, Discord and Reddit.

Uniswap has a mobile app on the Apple App Store.

Uniswap Supported Cryptocurrencies

Uniswap supports trading on over 1093 cryptocurrencies on their platform. This exchange currently supports 10 of the top 30 market cap cryptocurrencies.

View all cryptocurrencies Uniswap supports

- !

- $0XGAS

- $60

- $79

- $BETS

- $BIG

- $BITE

- $BUNNY

- $ECUM

- $ELY

- $GB

- $GTECH

- $LOOT

- $MILLIWAYS

- $MONG

- $OMNIX

- $PAAL

- $PEPE

- $PING

- $POWELL

- $REAR

- $REKT

- $SHEBA

- $SLS

- $STACK

- $VAULT

- 0KN

- 0X0

- 0XAI

- 0XAISWAP

- 0XB

- 0XCON

- 0XDEV

- 0XGROW

- 0XL

- 0XLAYER

- 1INCH

- 21INU

- 3

- 320I

- 42

- 369

- 3AC

- 4CHAN

- 7UP

- 990

- A.R.F.

- AAVE

- ACC

- ACQ

- ADDAMS

- ADEPT

- ADULT

- AEGIS

- AFK

- AG

- AGIX

- AI

- AI.COM

- AIBABYDOGE

- AIBOT

- AIE

- AIMBOT

- AIPAD

- AIX

- AKITA

- ALCZ

- ALD

- ALI

- ALIEN

- ALLAH

- ALPHACZ

- AMPAI

- AMPL

- ANTSPEPE

- APE

- APX

- AQTIS

- ARC

- ARTEM

- ASCN

- ASG

- ASIMO

- ASTO

- ASTRA

- ASTROX

- ATB

- ATOR

- ATR

- AUDIO

- AURORA

- AW3

- AZEE

- AZT

- BABYDOGE

- BABYFROGE

- BABYGROK

- BABYJESUS

- BABYSHIB

- BAD

- BAG

- BAI

- BANANA

- BANANS

- BANGER

- BANK

- BARD

- BART

- BASED

- BAZED

- BB

- BBANK

- BBETS

- BBOX

- BBRICS

- BBUD

- BCAT

- BCB

- BDP

- BEAM

- BEAST

- BEEPAI

- BEET

- BEG

- BEN

- BENANCE

- BEND

- BEPRO

- BETIT

- BETROCK

- BETS

- BEZOGE

- BEZOS

- BGFY

- BGPT

- BIBLE

- BIGF

- BITCH

- BITCOIN

- BITCRUNCH

- BITROCK

- BLACK

- BLADE

- BLANK

- BLAST

- BLH

- BLOCK

- BLOX

- BLUESPARROW

- BLZE

- BM

- BOB

- BOBER

- BOBO

- BOBONK

- BOIS

- BONE

- BOTC

- BOTTO

- BOWIE

- BPEEL

- BREED

- BREPE

- BRISE

- BRIX

- BROK

- BS

- BS9000

- BST

- BTC2.0

- BTCS

- BTX

- BULL

- BULLCEMBER

- BULLETPF

- BUZZ

- BX

- BXBT

- BXX

- BYPASS

- BZN

- C

- CACR

- CAESAR

- CAFF

- CAG

- CAGA

- CAI

- CAL

- CAMEL

- CAMP

- CANCEL

- CARDS

- CAVE

- CAW

- CBOT

- CC

- CD

- CELL

- CEX

- CFU

- CGG

- CH

- CHADINDEX

- CHAIN

- CHAINS

- CHAMPZ

- CHATX

- CHEX

- CHIBA

- CHIPPO

- CHOP

- CHURCH

- CLIPPY

- CLOSEDAI

- CLS

- CLY

- CMB

- CMBOT

- CNOTES

- COF

- COLA

- COMMIE

- COPI

- COVAL

- CPOOL

- CR

- CRAMER

- CRE

- CREDI

- CRMT

- CRO

- CROC

- CRU

- CSCS

- CTRL

- CTRUCK

- CUBE

- CUCK

- CUDOS

- CULT

- CUMINU

- CX

- CYBA

- CYBER

- CYBERBEAST

- CYBERTRUCK

- CYBERTRUCK911

- CYBRTRK

- CZ

- D/ACC

- DAI

- DAN

- DANK

- DAO

- DAWG

- DD

- DDIM

- DDT

- DEAL

- DECAL

- DEDE

- DEFX

- DEJITARUSHIRUDO

- DELETE

- DERANGED

- DERC

- DETF

- DEVS

- DEXIO

- DEXT

- DEXTF

- DFUND

- DFYN

- DG

- DGNRT

- DICK

- DIDDY

- DINE

- DINERO

- DIONE

- DISEASEX

- DISNEY

- DJCAT

- DM

- DMIND

- DMTR

- DOG

- DOGB

- DOGE-1

- DOGE1

- DOGE2.0

- DOGE2.0/HAY

- DOGEAI

- DOJO

- DOMI

- DORK

- DORKL

- DORNADO

- DPAY

- DPI

- DPR

- DRAGON

- DRC

- DROLL

- DS

- DSLA

- DSQ

- DSX

- DUA

- DUB

- DUBBZ

- DUCC

- DUCK

- DUCKS

- DUETAI

- DXG

- DYP

- E/ACC

- EARN

- EBOX

- ECASH

- EDOG

- EDOGE

- EJS

- ELIZA

- ELMO

- ELON

- EMU

- ENIGMA

- EPIK

- ERN

- ESPR

- ETE

- ETF

- ETF-ETH

- ETFBOT

- ETH2.0

- ETHC

- ETHEREUM

- ETX

- EXRD

- EYEBOT

- F

- FAA

- FAC

- FAI

- FAKEAI

- FALKOR

- FANX

- FARM

- FDUSD

- FEAR

- FEG

- FET

- FIDO

- FINE

- FIRSTMEME

- FIRSTTRUCK

- FKWALMART

- FLEX

- FLOKI

- FLUID

- FLX

- FM

- FMS

- FNVG

- FOUR

- FOX

- FRAX

- FRIN

- FRM

- FROBOT

- FROGE

- FROGEMON

- FRT

- FSD12

- FST

- FT

- FTG

- FTWGID

- FTX2.0

- FUCK

- FUFU

- FUNDED

- FUSE

- FUSION

- FX1

- FXI

- FXS

- FYM

- FYW

- G

- GALA

- GAMER

- GAMMA

- GDAG

- GEC

- GEEQ

- GEKE

- GEKKO

- GEMINI

- GENESYSCODE

- GETH

- GF

- GFB

- GFM

- GFX

- GFY

- GFY2

- GFY2.0

- GFY6900

- GFYZ

- GIGA

- GINGER

- GLY

- GM

- GMBT

- GME

- GMEE

- GMFAM

- GNO

- GNOME

- GOAT

- GODPILL

- GOLD

- GOOD

- GORILLA

- GRIMACE

- GRINCH

- GROBOT

- GROC

- GROGE

- GROK

- GROK-2

- GROK2

- GROK2.0

- GROK3K

- GROK95

- GROKA

- GROKAI

- GROKDOGE

- GROKGPT

- GROKII

- GROKINU

- GROKX

- GROOOOOK

- GROPAD

- GROQ

- GROX

- GRT

- GRōK

- GSS

- GSWAP

- GTA6

- GTAVI

- GTX

- GTY

- GUILD

- GUISE

- GUMMY

- GWEI

- H2G2

- H2O

- HACK

- HALAL

- HALFBTC

- HAVOC

- HAY

- HBGFY

- HBOT

- HDRN

- HEART

- HELLO

- HEX

- HEYBOB

- HIBA

- HIBOB

- HILO

- HMS

- HODL

- HOE

- HOGE

- HOICHI

- HOLD

- HOLE

- HOLY

- HOPPY

- HORD

- HOSHI

- HTB

- HUMANGROK

- HUSKY

- HUSL

- HYPC

- HYPR

- IBIT

- IBTC

- ID

- IDE

- IDGAF

- IDIOT

- IGORGABRIELAN

- ILY

- IMGNAI

- INJ

- INT

- INUS

- INVOKE

- INX

- IPVT

- ISAACNEWTON

- ISP

- ISWAP

- IXS

- JEPE

- JEST

- JESUS

- JGGY

- JIM

- JJ

- JNGL

- JOE

- JONATHAN

- JOSH

- JUP

- JVL

- KAI

- KALM

- KAP

- KAT

- KATA

- KDLC

- KEKE

- KEKEC

- KET

- KEVIN

- KINGDOM

- KNDX

- KOMPETE

- KONGZ

- KOTOV2

- KUIPER

- LADYS

- LARRY

- LBR

- LCX

- LEASH

- LEOX

- LESLIE

- LEX

- LFG

- LIFT

- LILA

- LINK

- LINQ

- LINU

- LISA

- LITH

- LIVE

- LLC

- LMI

- LMWR

- LNDRY

- LOFI

- LON

- LOOKS

- LOOP

- LP

- LSS

- LUCIDAI

- LUCKYSLP

- LUNA

- LUNA2.0

- LXIX

- LYF

- LYNX

- LYXE

- M87

- MAGIC

- MAGNET

- MAJIK

- MANA

- MANE

- MANYU

- MARBLE

- MARSH

- MARVIN

- MARY

- MATCH

- MATIC

- MATTER

- MBLK

- MBOT

- MBX

- MC

- MCE

- MCO2

- MEGA

- MEGABOT

- MEGAFORCE

- MEMEFROG

- MEO

- MEOWL

- MERCURY

- METAMEME

- METAV

- METIS

- METROIDX

- MEVFREE

- MF

- MIKSU

- MIKUAI

- MILEI

- MILK

- MIND

- MIR

- MITX

- MIXCOIN

- MIXIT

- MKR

- MLT

- MM

- MOCK

- MOG

- MOLY

- MOMO

- MONA

- MONKE

- MONKEYSGEORGE

- MONONOKE-INU

- MOONS

- MOOON

- MORI

- MOROS

- MORRA

- MSTR

- MTE

- MUSK

- MVI

- MYX

- N

- N0N-PR0FIT$$

- NAAI

- NATI

- NCDT

- NEBO

- NEBULA

- NERD

- NERF

- NEST

- NEURALINK

- NEURONI

- NEWS

- NEX

- NFAI

- NGL

- NHI

- NLP

- NOIA

- NOISEGPT

- NOTAPE

- NP

- NPC

- NTVRK

- NTX

- NU

- NUBTC

- NUDE

- NXRA

- NYAN

- O

- OCAI

- OCC

- OCD

- OCEAN

- OGGY

- OLAI

- OLAS

- OMFG

- OMFGDECAL

- OMIKAMI

- OMNIBLM2

- ONE

- ONIC

- OPENAI

- OPOE

- OPTIMUS

- OPTIX

- OPUL

- ORACLE

- ORAI

- ORAO

- ORB

- ORBS

- ORD

- OS

- OSAK

- OTCBOT

- OTSEA

- OUCHI

- OX

- P2P

- P3PE

- PAID

- PAIN

- PALM

- PANDA

- PANO

- PAPER

- PARA

- PAXG

- PBOX

- PBX

- PEAR

- PEEPO

- PEIPEI

- PEPE

- PEPE2.0

- PEPEC

- PEPECOIN

- PEPEGO

- PEPEGROK

- PEPESANTA

- PERL

- PERPS

- PHIL

- PHILO

- PHILOSEMITE

- PHYSICS

- PIGEON

- PINT

- PIRB

- PKC

- PLANET

- PLAY

- PLEB

- PLTR

- PMPY

- PNDC

- PNEUMONOULTRAMICROSCOPICSILICOVOLCANOCONIOSIS

- POLC

- POLS

- POOH

- PORTAL

- PR0FIT

- PRAY

- PRE

- PREME

- PREMIUM+

- PRISMA

- PROGE

- PROMPTIDE

- PROPC

- PROPHET

- PROS

- PSWEAR

- PTOY

- PUG

- PYRO

- Q

- Q*

- QBIT

- QNODE

- QNT

- QOM

- QR

- QUAD

- QUID

- QWEN

- R=M

- RACA

- RAIN

- RARI

- RAT

- RBC

- RCR

- RDT

- REALM

- REEF

- REEY

- REP

- REVV

- REVV/SAND

- RFOX

- RICK

- RICKINU2RICKINU2RICKINU2RICKINU2RICKINU2RICKINU2RICKINU2RICKINU2RICKINU2RICKINU2

- RIDE

- RING

- RIO

- RJV

- RKR

- RMITW

- RNDR

- ROAD

- ROBO

- ROCI

- ROCK

- ROCKI

- ROKO

- ROOT

- ROULETTEBOT

- ROUTE

- RS

- RSC

- RSNAI

- RST

- RUNE

- RUNWAY

- RUSD

- RVF

- RVS

- RVST

- SACA

- SAFEMARS

- SAINT

- SAITO

- SALD

- SAND

- SANI

- SANTA

- SATAN

- SATS

- SBEAST

- SCHIZ

- SCOPE

- SDA

- SDAO

- SDAX

- SEED

- SEMI

- SENATE

- SENT

- SENTAI

- SEXY

- SFD

- SFI

- SFUND

- SG5AI

- SGROK

- SGT

- SHEZMU

- SHIA

- SHIB

- SHIBA

- SHIBA2.0

- SHIBAKU

- SHIBDOGE

- SHIDO

- SHIELD

- SHIKEREUM

- SHITEX

- SHS

- SHUB

- SIDE

- SIDUS

- SIMP

- SIPHER

- SLC

- SMAI2.0

- SMUDGE

- SNAIL

- SNIFF

- SNOO

- SNX

- SOCBOT

- SOLANA

- SOLAR

- SOLARAI

- SOLAREUM

- SOLIDX

- SONIC

- SONO

- SOPH

- SOY

- SPARKO

- SPEC

- SPECTRE

- SPILLWAYS

- SPOOL

- SPRM

- SPX

- SQUID

- SQUIDGROK

- SQUIDGROW

- SRM

- SS

- ST8

- STABY

- STARL

- STARMAN

- STARRY

- STARSHIP

- STATS

- STC

- STETH

- STOS

- STREAK

- STRNGR

- SU

- SUDO

- SUPER

- SUSHI

- SUZHU

- SWAP

- SWFTC

- SYBL

- SYLO

- SYN

- SYNDEMIC

- SYNR

- T3

- TAC

- TAIL

- TAMA

- TAONU

- TEL

- TENG

- TESLA

- TET

- TFM

- THANKYOU

- THC

- THND

- THREE

- TI

- TIME

- TKST

- TLG

- TOAD

- TOILET

- TOKE

- TOKEN

- TONE

- TOOLS

- TOPIA

- TORN

- TOWER

- TRACKIFY

- TRADE

- TRENDX

- TRL

- TRU

- TRUCK

- TRUMP

- TRX

- TSC

- TSLA

- TSUKA

- TURBO

- TVK

- TWO

- TXN

- TYRANT

- TYRION

- UAE

- UBT

- UBX

- UCS

- UDT

- UFO

- UMB

- UMLB

- UNI

- UNI-V2

- UNIBOT

- UNIBRIDGE

- UNIFI

- UNIX

- UNLEASH

- UOS

- UPAI

- UPCEMBER

- UPI

- URUS

- USA

- USDC

- USDT

- UU

- VAI

- VAL

- VANRY

- VB

- VBUCKS

- VD

- VDANK

- VEIL

- VEMP

- VERI

- VETME

- VIELENDANK

- VIRALX

- VLX

- VOLT

- VOW

- VPP

- VR

- VRA

- VRD

- VS

- VXAI

- WAGMIGAMES

- WAGYU

- WAIT

- WALLE

- WALMART

- WALV

- WARPED

- WAS

- WATSON

- WBTC

- WCC

- WEB

- WEBAI

- WETH

- WHITE

- WHITELUNG

- WHORE

- WIFE

- WIGGER

- WIK

- WIKICHAN

- WILD

- WILDCAT

- WINR

- WINVICTORYLOVE

- WIZ

- WMT

- WOJAK

- WOO

- WOXEN

- WPC

- WPOKT

- WRLD

- WRP

- WSKR

- WSM

- WTF

- WVL

- WZNN

- X

- X-AI

- X-MASS

- X2Y2

- XAI

- XCAD

- XCEPT

- XCOM

- XD

- XDB

- XDOGE

- XED

- XEN

- XEND

- XENO

- XFUND

- XGPT

- XGROK

- XI

- XMAS

- XMON

- XMUSK

- XNOVA

- XOR

- XPERP

- XPPT

- XPR

- XRP

- XRP20

- XRT

- XTOOL

- XTRACK

- XTRUCK

- XVG

- XYO

- YDF

- YES

- YESHUA

- YFII

- YOBASE

- ZAPEX

- ZAPI

- ZCX

- ZETA

- ZEUS

- ZEZE

- ZHUPERCYCLE

- ZHUSU

- ZIG

- ZKS

- ZOOK

- ZOOMER

- ZYN

Trading Experience

Trading on Uniswap is easy for anyone familiar with digital wallets such as MetaMask or Coinbase Wallet. The platform’s swap interface was created for ease of use, giving users direct access to swap ERC-20 tokens.

Focusing on offering an effortless trading experience without the complex features found in traditional exchanges.

Uniswap provides a user-friendly trading experience designed to meet the needs of an array of crypto traders. From beginners making their first token swap transaction to veteran traders searching for efficient liquidity for larger exchanges, its interface was created for smooth trade execution.

Exchange’s automated liquidity protocol has transformed the role of market makers by creating an avenue for anyone to participate in providing liquidity-earning transaction fees without needing an extensive background in cryptocurrency trading.

Uniswap Fees

Uniswap stands apart from traditional exchanges by forgoing typical brokerage fees and basing transaction fees on congestion levels and gas costs on Ethereum Mainnet.

Liquidity providers earn a commission from trading fees, incentivizing their provisioning to pools.

Uniswap’s approach to transaction fees highlights its dedication to an open financial market. Instead of providing static fee structures, its dynamic fee adjustment feature dynamically adjusts fees based on Ethereum network congestion, creating flexible trading fees that may prove more favourable for its users.

With this model, Uniswap ensures that liquidity providers are compensated for their contribution to maintaining the exchange’s liquidity pools – essential to maintaining continuous trading activity on its platform.

| Type | Fee |

|---|---|

| Trading Fee | 0.30% |

Security - Is Uniswap Safe?

Security on Uniswap is provided by the Ethereum blockchain. Without a centralized authority overseeing transactions, smart contracts provide protection.

Uniswap’s decentralised architecture also makes it highly resistant to attacks on liquidity providers or users’ digital wallets, eliminating any single point of failure for the platform.

Uniswap’s security framework is an intricate combination of Ethereum’s blockchain safeguards and smart contract technology’s inherent protections, with regular audits conducted by an analyst team to boost user confidence in Uniswap’s resilience against malicious attacks.

Uniswap’s decentralized model ensures there is no central repository of funds that could become targets of fraud in other centralized exchanges, thereby improving transaction security and protecting digital assets belonging to its users.

Uniswap Customer Support

Customer support on Uniswap differs from traditional service models due to its decentralised structure. Though there is no direct customer service hotline, users can find help through community forums and documentation – connecting to an active group of users and developers.

Uniswap’s support model exemplifies a larger shift towards community-driven service models within cryptocurrency. As a decentralized exchange, Uniswap does not employ traditional customer service representatives but instead relies on its community’s collective knowledge and expertise to assist its users.

This model allows users to engage with one another for support while taking advantage of extensive online documentation and forums – creating an atmosphere of community that often is lacking with traditional service models.

Uniswap Support Channels

How to Sign Up on Uniswap

- Create Account - Visit the Uniswap website and fill out the create account form. You'll need to include a valid email, set your password and type in other details like your phone number and name.

- Verify Account - Confirm your email, you should get an email asking you to verify your account creation.

- Transferring Funds - Once your account has been verified, you'll be able to deposit using the methods listed below. Remember this exchange only supports depositing fiat currencies through third party apps it supports.

- Start Trading Crypto - That's it! You should now have everything in place to start trading.

Deposit Methods

Uniswap Alternatives

1inch

Total Supported Cryptocurrencies

267+

Trading Fees

0%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR + 10 others

OKX

Total Supported Cryptocurrencies

320+

Trading Fees

0.08% - 0.10%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 85 others

Bancor Network

Total Supported Cryptocurrencies

239+

Trading Fees

0.1%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 70 others

Final Thoughts

Uniswap stands as an impressive testament to innovation in the cryptocurrency space. Its automated market maker system provides an exciting alternative to centralised trading models and an autonomous trading experience for cryptocurrency enthusiasts.

Uniswap is an inspirational story in an ever-evolving landscape of cryptocurrency exchanges. As digital finance matures, such platforms are critical in shaping market dynamics and opening access to asset trading.

Exchanges like Uniswap are revolutionizing how liquidity is delivered and shaping the future landscape of decentralized trading and governance in crypto.

Uniswap FAQs

Uniswap is a decentralized finance (DeFi) platform that operates on blockchain technology, which has intrinsic security features such as encryption and smart contracts. However, like any online platform, users should practice due diligence and safety precautions, such as safeguarding private keys and being aware of phishing scams.

Uniswap does not hold your funds, so there is no traditional withdrawal process. Instead, you interact directly with the smart contracts using a cryptocurrency wallet.

If you want to “withdraw” your assets, you would trade your tokens for a stablecoin or another cryptocurrency and then transfer them to an exchange or wallet that allows you to convert into fiat currency.

Uniswap as a platform has not been hacked, but the DeFi space has witnessed incidents where users have lost funds due to smart contract vulnerabilities or other exploits in peripheral systems. Users should stay informed about the latest security updates and practices.

People use Uniswap primarily for swapping different Ethereum-based tokens without needing an intermediary. It’s also used for providing liquidity to the market and earning trading fees in return, as part of liquidity pools.

Uniswap fees can be high due to Ethereum network congestion, which increases gas prices. Gas prices are the fees required to conduct a transaction on the Ethereum network, and they fluctuate based on demand.

Transactions on Uniswap may fail due to several reasons, such as insufficient gas fees leading to an incomplete transaction, slippage settings being too low in a highly volatile market, or network congestion causing delays.

Uniswap typically charges a 0.3% fee per swap, which is automatically taken from the traded amount. This fee goes to liquidity providers as an incentive for supplying liquidity to the pool.

Uniswap User Reviews

0.0 out of 5.0

0 reviews

No reviews yet for Uniswap - be the first to review!

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.